Business, 15.04.2020 01:49, brandonthomas11

Barley Hopp, Inc., manufactures custom-ordered commemorative beer steins. Its standard cost information follows:

Standard Quantity Standard Price Standard Unit

(Rate) Cost

Direct materials (clay) 1.70 lbs. $1.80 per lb. $3.06

Direct labor 1.70 hrs. $10.00 per hr. $17.00

Variable manufacturing overhead 1.70 hrs. $1.10per hr. $1.87

(based on direct labor hours)

Fixed manufacturing overhead 2.30

($402,500.00 ÷ 175,000.00 units)

Barley Hopp had the following actual results last year:

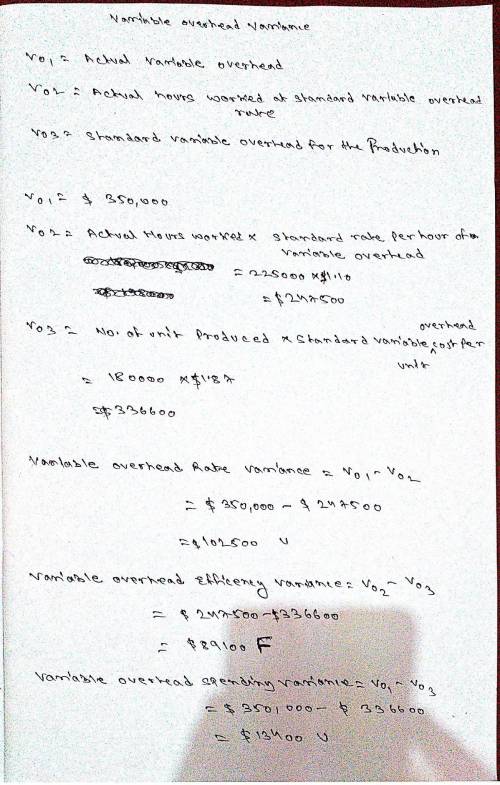

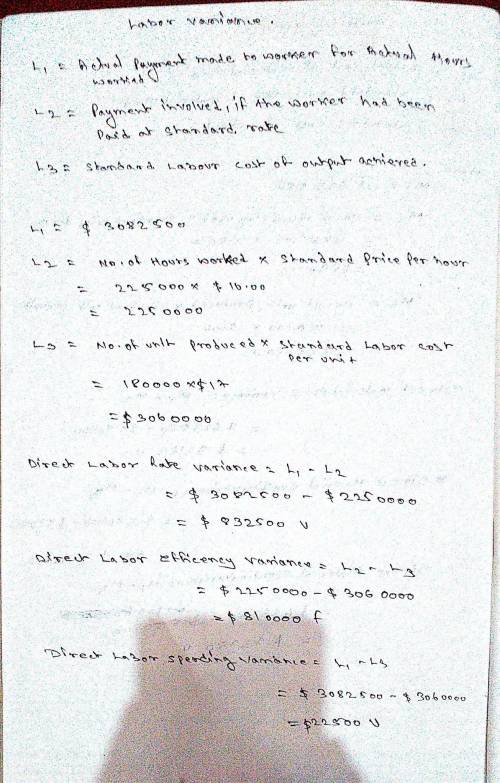

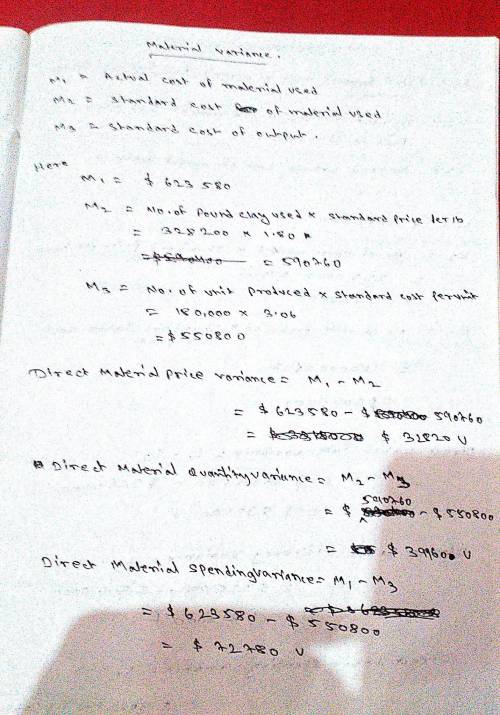

Number of units produced and sold 180,000

Number of pounds of clay used 328,200

Cost of clay $623,580

Number of labor hours worked 225,000

Direct labor cost $3,082,500

Variable overhead cost $350,000

Fixed overhead cost $400,000

Required:

1. Calculate the direct materials price, quantity, and total spending variances for Barley Hopp. Indicate the effect of each variance as favorable or unfavorable.

2. Calculate the direct labor rate, efficiency, and total spending variances for Barley Hopp. Indicate the effect of each variance as favorable or unfavorable.

3. Calculate the variable overhead rate, efficiency, and total spending variances for Barley Hopp. Indicate the effect of each variance as favorable/Overapplied or unfavorable/underapplied.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 07:30, alexanderavrett

Awell-written business plan can improve your chances of getting funding and give you more free time. improved logistics. greater negotiating power.

Answers: 1

Business, 22.06.2019 14:30, karleygirl2870

Your own record of all your transactions. a. check register b. account statement

Answers: 1

Business, 22.06.2019 15:30, TerronRice

In 2015, lori assigned a paid-up whole life insurance policy to an irrevocable life insurance trust (ilit) for the benefit of her three children. the ilit contained a crummey provision for the benefit of each child. at the time of the transfer, the whole life insurance policy was valued at $200,000, and since lori had not made any other taxable gifts during her lifetime, she did not owe any gift tax. lori died in 2016, and the face value of the whole life insurance policy of $2,000,000 was paid to the ilit. regarding this transfer, how much is included in lori’s gross estate at her death?

Answers: 1

Do you know the correct answer?

Barley Hopp, Inc., manufactures custom-ordered commemorative beer steins. Its standard cost informat...

Questions in other subjects:

Mathematics, 13.11.2019 04:31