Business, 14.04.2020 22:14, superstarsara5ouh83x

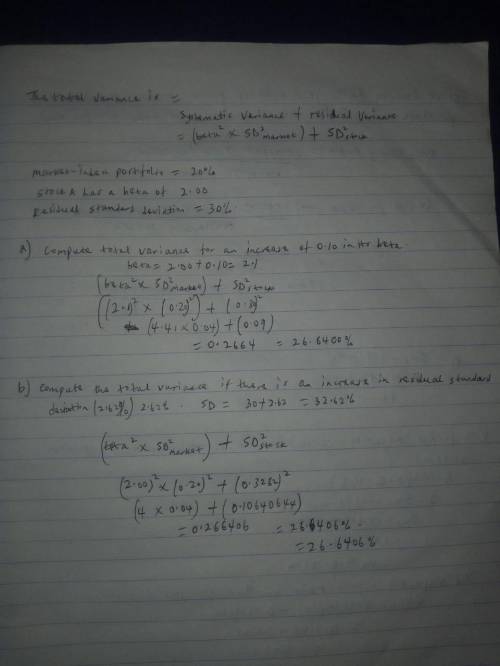

The standard deviation of the market-index portfolio is 20%. Stock A has a beta of 2.00 and a residual standard deviation of 30%.

a. Calculate the total variance for an increase of 0.10 in its beta. (Do not round intermediate calculations. Round your answer to the nearest whole number.)

b. Calculate the total variance for an increase of 2.62% in its residual standard deviation?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 00:50, yolo123321

Cool beans is a locally owned coffee shop that competes with two large coffee chains, planeteuro and frothies. alicia, the owner, hired two students to count the number of customers that entered each of the coffee shops to estimate what percent of people who are interested in coffee are visiting each shop. after a week, the students found the following results: 589 visited cool beans, 839 visited planeteuro, and 1,290 visited frothies. the students were surprised that cool beans had 139 visits on monday which represented 59% of all people who visited one of the three coffee shops on mondays. how many people visited one of the three coffee shops during the week?

Answers: 2

Business, 22.06.2019 03:00, autumn8668

Afirm's before-tax cost of debt, rd, is the interest rate that the firm must pay on debt. because interest is tax deductible, the relevant cost of debt used to calculate a firm's wacc is the cost of debt, rd (1 – t). the cost of debt is used in calculating the wacc because we are interested in maximizing the value of the firm's stock, and the stock price depends on cash flows. it is important to emphasize that the cost of debt is the interest rate on debt, not debt because our primary concern with the cost of capital is its use in capital budgeting decisions. the rate at which the firm has borrowed in the past is because we need to know the cost of capital. for these reasons, the on outstanding debt (which reflects current market conditions) is a better measure of the cost of debt than the . the on the company's -term debt is generally used to calculate the cost of debt because more often than not, the capital is being raised to fund -term projects. quantitative problem: 5 years ago, barton industries issued 25-year noncallable, semiannual bonds with a $1,600 face value and a 8% coupon, semiannual payment ($64 payment every 6 months). the bonds currently sell for $845.87. if the firm's marginal tax rate is 40%, what is the firm's after-tax cost of debt? round your answer to 2 decimal places. do not round intermediate calcu

Answers: 3

Business, 22.06.2019 23:50, iiisavageoreo

In june, one of the processinthe assembly department started the month with 25,000 units in its beginning work in process inventory. an additional 310,000 units were transferred in from the prior department during the month to begin processing in the assembly department. there were 30,000 units completed and transferred to the next processing department during the month. how many units the assembly department started the month with 25,000 units in its beginning work in process inventory. an additional 310,000 units were transferred in from the prior department during the month to begin processing in the assembly department. there were 30,000 units completed and transferred to the next processing department during the month. how many units were in its ending work in process inventory

Answers: 2

Business, 23.06.2019 02:30, nauticajanke03

The wall street journal reported that over a recent five-month period, a downturn in the economy has caused endowments to decline 23%. what is the estimate of the dollar amount of the decline in the total endowments held by these 10 universities (to the nearest billion)?

Answers: 3

Do you know the correct answer?

The standard deviation of the market-index portfolio is 20%. Stock A has a beta of 2.00 and a residu...

Questions in other subjects:

Mathematics, 18.03.2021 01:00

Chemistry, 18.03.2021 01:00

Biology, 18.03.2021 01:00

History, 18.03.2021 01:00

Biology, 18.03.2021 01:00

English, 18.03.2021 01:00