Business, 11.04.2020 04:50, BreadOfTheBear

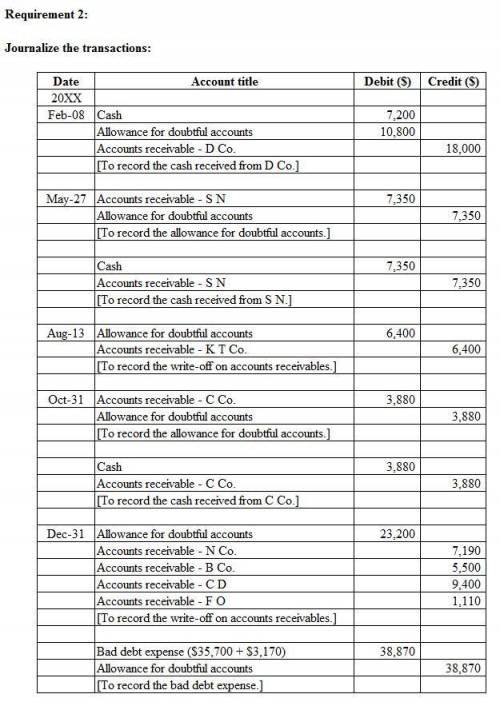

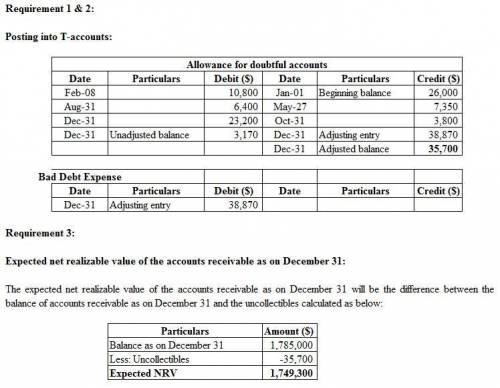

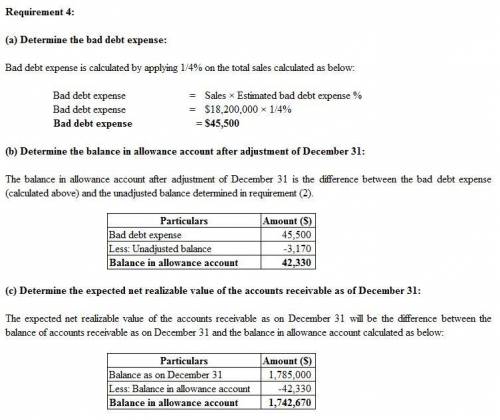

The following transactions were completed by The Irvine Company during the current fiscal year ended December 31: Feb. 8 Received 40% of the $18,000 balance owed by DeCoy Co., a bankrupt business, and wrote off the remainder as uncollectible. May 27 Reinstated the account of Seth Nelsen, which had been written off in the preceding year as uncollectible. Journalized the receipt of $7,350 cash in full payment of Seth’s account. Aug. 13 Wrote off the $6,400 balance owed by Kat Tracks Co., which has no assets. Oct. 31 Reinstated the account of Crawford Co., which had been written off in the preceding year as uncollectible. Journalized the receipt of $3,880 cash in full payment of the account. Dec. 31 Wrote off the following accounts as uncollectible (compound entry): Newbauer Co., $7,190; Bonneville Co., $5,500; Crow Distributors, $9,400; Fiber Optics, $1,110. Dec. 31 Based on an analysis of the $1,785,000 of accounts receivable, it was estimated that $35,700 will be uncollectible. Journalized the adjusting entry. Required: 1. Record the January 1 credit balance of $26,000 in a T account for Allowance for Doubtful Accounts. 2. A. Journalize the transactions. For the December 31 adjusting entry, assume the $1,785,000 balance in accounts receivable reflects the adjustments made during the year. Refer to the chart of accounts for a listing of the account titles the company uses. B. Post each entry that affects the following selected T accounts and determine the new balances: Allowance for Doubtful Accounts and Bad Debt Expense. 3. Determine the expected net realizable value of the accounts receivable as of December 31 (after all of the adjustments and the adjusting entry). 4. Assuming that instead of basing the provision for uncollectible accounts on an analysis of receivables, the adjusting entry on December 31 had been based on an estimated expense of ¼ of 1% of the net sales of $18,200,000 for the year, determine the following: A. Bad debt expense for the year. B. Balance in the allowance account after the adjustment of December 31. C. Expected net realizable value of the accounts receivable as of December 31.

1. Record the January 1 credit balance of $26,000 in a T account for Allowance for Doubtful Accounts.

2.

B. Post each entry that affects the following selected T accounts and determine the new balances: Allowance for Doubtful Accounts and Bad Debt Expense.

Allowance for Doubtful Accounts

Feb. 8 Jan. 1 Balance

Aug. 13 May 27

Dec. 31 Oct. 31

Dec. 31 Adjusting Entry

Dec. 31 Unadjusted Balance Dec. 31 Adj. Balance

Bad Debt Expense

Dec. 31 Adjusting Entry

Points:

0.44 / 1

Feedback

Check My Work

Set up T accounts.

Journal

Shaded cells have feedback.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 19:50, alexdziob01

Right medical introduced a new implant that carries a five-year warranty against manufacturer’s defects. based on industry experience with similar product introductions, warranty costs are expected to approximate 2% of sales. sales were $8 million and actual warranty expenditures were $42,750 for the first year of selling the product. what amount (if any) should right report as a liability at the end of the year?

Answers: 2

Business, 22.06.2019 22:00, lionscoachjose

Most economists report the elasticity of demand asa. the absolute value of the actual number. b. a negative number, since price and quantity demanded move in opposite directions. c. a percentage, since both the numerator and denominator are percentages. d. a dollar amount, since we are measuring the change in price.

Answers: 2

Business, 23.06.2019 00:00, areanna02

An attorney came to work on a saturday. when he signed in, he was advised by the morning security guard employed by the building management that he must be out of the building by 5 p. m., when it closes. however, he stayed past 5 p. m. to complete a brief that had to be filed on monday morning. at 5: 15 p. m., the afternoon security guard set the locks on all the doors of the building and left. because she was in a hurry, she did not check the sign-in sheet to make sure that everyone had signed out, contrary to mandatory procedures. when the attorney tried to exit 15 minutes later, he discovered that the doors were all locked and could not be opened from the inside. he used his cell phone to call for , and a supervisor from the building arrived and let him out shortly thereafter. if the attorney sues the building management for false imprisonment, is he likely to win?

Answers: 1

Do you know the correct answer?

The following transactions were completed by The Irvine Company during the current fiscal year ended...

Questions in other subjects:

Mathematics, 23.10.2020 20:40

History, 23.10.2020 20:40

English, 23.10.2020 20:40

English, 23.10.2020 20:40