Business, 08.04.2020 04:24, lovelyheart5337

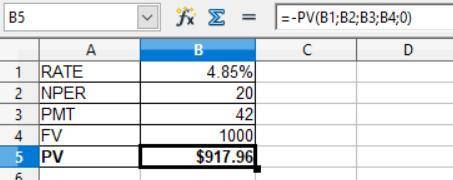

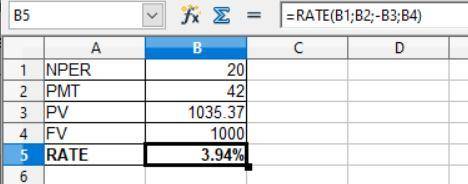

Suppose a ten-year, $ 1 comma 000 bond with an 8.4 % coupon rate and semiannual coupons is trading for $ 1 comma 035.37. a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? b. If the bond's yield to maturity changes to 9.7 % APR, what will be the bond's price?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 14:20, ssalusso7914

Cardinal company is considering a project that would require a $2,725,000 investment in equipment with a useful life of five years. at the end of five years, the project would terminate and the equipment would be sold for its salvage value of $400,000. the company’s discount rate is 14%. the project would provide net operating income each year as follows: sales $2,867,000 variable expenses 1,125,000 contribution margin 1,742,000 fixed expenses: advertising, salaries, and other fixed out-of-pocket costs $706,000 depreciation 465,000 total fixed expenses 1,171,000 net operating income $571,000 1. which item(s) in the income statement shown above will not affect cash flows? (you may select more than one answer. single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. any boxes left with a question mark will be automatically graded as incorrect.) (a)sales (b)variable expenses (c) advertising, salaries, and other fixed out-of-pocket costs expenses (d) depreciation expense 2. what are the project’s annual net cash inflows? 3.what is the present value of the project’s annual net cash inflows? (use the appropriate table to determine the discount factor(s) and final answer to the nearest dollar amount.) 4.what is the present value of the equipment’s salvage value at the end of five years? (use the appropriate table to determine the discount factor(s) and final answer to the nearest dollar amount.) 5.what is the project’s net present value? (use the appropriate table to determine the discount factor(s) and final answer to the nearest dollar amount.)

Answers: 2

Business, 23.06.2019 03:00, marvin07

On december 31, 2016, the decarreau, andrew, and bui partnership had the following fiscal year-end balance sheet: cash $10,000accounts receivable $20,000inventory $25,000plant assets - net $30,000loan to decarreau $18,000total assets $103,000accounts payable $14,000loan from bui $15,000decarreaua, capital (20%) $32,000andrew, capital (10%) $23,000bui, capital (70%) $19,000total liab./equity $103,000the percentages shown are the residual profit and loss sharing ratios. the partners dissolved the partnership on january 1, 2017, and began the liquidation process. during july the following events occurred: * receivables of $18,000 were collected.* all inventory was sold for $15,000.*all available cash was distributed on january 31, except for$8,000 that was set aside for contingent expenses. the book value of the partnership equity (i. e., total equity of the partners) on december 31, 2016 isa. $58,000b. $71,000c. $66,000d. $81,000

Answers: 1

Business, 24.06.2019 02:30, noellelovebug1214

Which forms of income are included in the income-based method of calculating gdp?

Answers: 1

Business, 24.06.2019 07:00, Lydiac9243

Which of these will not cause an increase in aggregate demand

Answers: 2

Do you know the correct answer?

Suppose a ten-year, $ 1 comma 000 bond with an 8.4 % coupon rate and semiannual coupons is trading f...

Questions in other subjects:

Mathematics, 13.01.2020 18:31

Mathematics, 13.01.2020 18:31

Geography, 13.01.2020 18:31

Mathematics, 13.01.2020 18:31

Biology, 13.01.2020 18:31

Social Studies, 13.01.2020 18:31