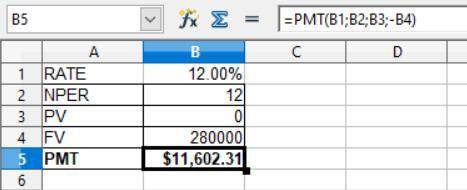

You have an absolutely brilliant child who is six years old and will be attending a private college in twelve years. You know that in twelve years a four-year college will cost at least $70,000 per year (total $280,000), including tuition, books, and room and board. You determine that you can earn 12 percent on a mutual fund investment during the next twelve years, and invest at the beginning of each year. How much will your total investment be for the twelve-year period?

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 21:00, robertsabbiegale

Add the mips assembly language instructions (after main: ) to complete the following (in this order). do not skip steps. use other registers as needed. actions: 1. initialize the register $s0 to 35 2. prompt the user to enter a number, read the number and then put it into register $s1 3. prompt the user to enter a number, read the number and then put it into register $s2 4. store the value in $s1 into the memory at address 0x10010000. 5. store the value in $s2 into the memory at address 0x10010004. 6. calculate the value of $s0 - $s1 $s2 and store the result in the memory at address 0x10010008. 7. print the following output each on its own line. you will need to determine the location of each of the strings from the beginning of the memory segment a. your name b. the value in address 0x10010000 c. the value in address 0x10010004 d. the value in address 0x10010008 8. exchange or swap the values in $s1 and $s2 9. set the value in $s0 to -$s0

Answers: 2

Business, 22.06.2019 06:30, coralaguilar1702

73. calculate the weighted average cost of capital (wacc) based on the following information: the equity multiplier is 1.66; the interest rate on debt is 13%; the required return to equity holders is 22%; and the tax rate is 35%. (a) 15.6% (b) 16.0% (c) 15.0% (d) 16.6% (e) none of the above

Answers: 2

Business, 22.06.2019 11:20, murarimenon

Camilo is a self-employed roofer. he reported a profit of $30,000 on his schedule c. he had other taxable income of $5,000. he paid $3,000 for hospitalization insurance. his self-employment tax was $4,656. he paid his former wife $4,000 in court-ordered alimony and $4,000 in child support. what is the amount camilo can deduct in arriving at adjusted gross income (agi)?

Answers: 2

Business, 22.06.2019 20:30, allakhalilpea0zc

Caleb construction (cc) incurs supervisor salaries expense in the construction of homes. if cc manufactures 100 homes in a year, fixed supervisor salaries will be $400,000. with the current construction supervisors, cc's productive capacity is 150 homes in a year. however, if cc is contracts to build more than 150 homes per year, it will need to hire additional supervisors, which are hired as full-time rather than temporary employees. cc's productive capacity would then become 200 homes per year, and salaries expense would increase to $470,000. how would cc’s salaries expense be properly classified? fixed variable mixed stepped curvilinear

Answers: 3

Do you know the correct answer?

You have an absolutely brilliant child who is six years old and will be attending a private college...

Questions in other subjects:

History, 16.02.2021 01:10

Advanced Placement (AP), 16.02.2021 01:10

Mathematics, 16.02.2021 01:10