Business, 07.04.2020 20:32, breannamiller0822

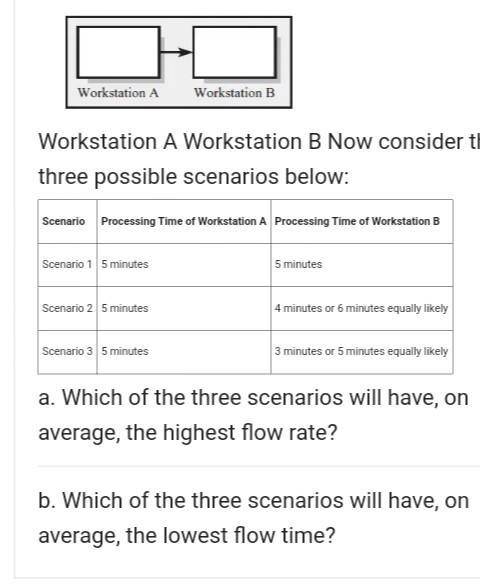

Suppose a process contains two workstations that operate with no buffer between them. a. Which of the three scenarios will have, on average, the highest flow rate? b. Which of the three scenarios will have, on average, the lowest flow time?

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 17:50, caitlinhardin8553

Which of the following best explains why a large company can undersell small retailers? a. large companies can offer workers lower wages because they provide more jobs. b. large companies can pay their employees less because they do unskilled jobs. c. large companies can negotiate better prices with wholesalers. d. large companies have fewer expenses associated with overhead.

Answers: 1

Business, 22.06.2019 10:00, Randomkid0973

University car wash built a deluxe car wash across the street from campus. the new machines cost $219,000 including installation. the company estimates that the equipment will have a residual value of $19,500. university car wash also estimates it will use the machine for six years or about 12,500 total hours. actual use per year was as follows: year hours used 1 3,100 2 1,100 3 1,200 4 2,800 5 2,600 6 1,200 prepare a depreciation schedule for six years using the following methods: 1. straight-line. 2. double-declining-balance. 3. activity-based.

Answers: 1

Business, 22.06.2019 15:20, ashleyuchiha123

Gulliver travel agencies thinks interest rates in europe are low. the firm borrows euros at 5 percent for one year. during this time period the dollar falls 11 percent against the euro. what is the effective interest rate on the loan for one year? (consider the 11 percent fall in the value of the dollar as well as the interest payment.)

Answers: 2

Business, 22.06.2019 15:30, TerronRice

In 2015, lori assigned a paid-up whole life insurance policy to an irrevocable life insurance trust (ilit) for the benefit of her three children. the ilit contained a crummey provision for the benefit of each child. at the time of the transfer, the whole life insurance policy was valued at $200,000, and since lori had not made any other taxable gifts during her lifetime, she did not owe any gift tax. lori died in 2016, and the face value of the whole life insurance policy of $2,000,000 was paid to the ilit. regarding this transfer, how much is included in lori’s gross estate at her death?

Answers: 1

Do you know the correct answer?

Suppose a process contains two workstations that operate with no buffer between them. a. Which of th...

Questions in other subjects:

Biology, 14.11.2019 00:31

Chemistry, 14.11.2019 00:31

Mathematics, 14.11.2019 00:31

Social Studies, 14.11.2019 00:31

Arts, 14.11.2019 00:31

Spanish, 14.11.2019 00:31