Business, 07.04.2020 01:26, emmmmmily997

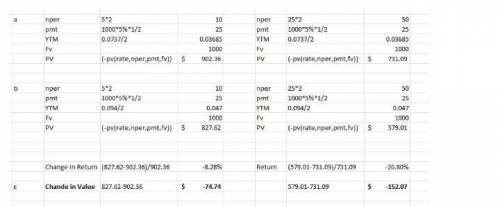

Assume that coupon interest payments are made semiannually and that par value is $1,000 for both bonds.

Bond A Bond B

Coupon rate 5.00% 5.00%

Time to maturity 5 years 25 years

Required return 7.37% 7.37%

a. Calculate the values of Bond A and Bond B. (Round your answers to 2 decimal places.)

b. Recalculate the bonds’ values if the required rate of return changes to 9.40%. (Round your answers to 2 decimal places.)

c. Calculate the increase or decrease in bond value based on the change in required return. (Round your answers to 2 decimal places.)

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 13:40, vanessam16

Salge inc. bases its manufacturing overhead budget on budgeted direct labor-hours. the variable overhead rate is $8.10 per direct labor-hour. the company's budgeted fixed manufacturing overhead is $74,730 per month, which includes depreciation of $20,670. all other fixed manufacturing overhead costs represent current cash flows. the direct labor budget indicates that 5,300 direct labor-hours will be required in september. the company recomputes its predetermined overhead rate every month. the predetermined overhead rate for september should be:

Answers: 3

Business, 22.06.2019 20:00, ethanyayger

Acompetitive market in healthcare would a. overprovide healthcare because the marginal social benefit of healthcare exceeds the marginal benefit perceived by consumers b. underprovide healthcare because it would eliminate medicare and medicaid c. underprovide healthcare because the marginal social benefit of healthcare exceeds the marginal benefit perceived by consumers d. overprovide healthcare because it would be similar to the approach used in canada

Answers: 1

Business, 23.06.2019 00:30, Lindy1862

Greentel, a telecom giant, has been using the service of orpheus inc. for training its employees. according to a deal signed by the two companies, orpheus inc. is not only responsible for training greentel's employees but also for providing comprehensive administrative services to the telecom giant. in this instance, greentel engages in

Answers: 1

Business, 23.06.2019 03:20, james169196

With only a part-time job and the need for a professional wardrobe, rachel quickly maxed out her credit card the summer after graduation. with her first full-time paycheck in august, she vowed to pay $270 each month toward paying down her $8 comma 368 outstanding balance and not to use the card. the card has an annual interest rate of 18 percent. how long will it take rachel to pay for her wardrobe? should she shop for a new card? why or why not?

Answers: 2

Do you know the correct answer?

Assume that coupon interest payments are made semiannually and that par value is $1,000 for both bon...

Questions in other subjects:

English, 29.01.2022 03:20

Mathematics, 29.01.2022 03:20

Mathematics, 29.01.2022 03:20

English, 29.01.2022 03:20

Mathematics, 29.01.2022 03:20