Business, 06.04.2020 23:29, dianamachado14

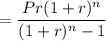

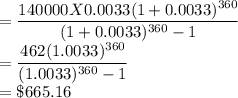

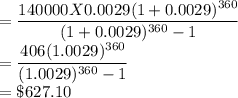

You need a loan of ​$140,000 to buy a home. Calculate your monthly payments and total closing costs for each choice below. Briefly discuss how you would decide between the two choices.

Choice​ 1: 30 ​-year fixed rate at 4 ​% with closing costs of ​$2100 and no points.

Choice​ 2: 30 ​-year fixed rate at 3.5 ​% with closing costs of ​$2100 and 4 points.

What is the monthly payment for choice​ 1? ​$ ​(Do not round until the final answer. Then round to the nearest cent as​ needed.)

What is the monthly payment for choice​ 2? ​$ ​(Do not round until the final answer. Then round to the nearest cent as​ needed.)

What is the total closing cost for choice​ 1? $

What is the total closing cost for choice​ 2? ​$

Why might choice 1 be the better​ choice?

A. The monthly payment is higher.

B. The monthly payment is lower.

C. The closing costs are lower.

D. The closing costs are higher.

Why might choice 2 be the better​ choice?

A. The closing costs are higher.

B. The closing costs are lower.

C. The monthly payment is higher.

D. The monthly payment is lower.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 00:50, abcdefg87

Consider each of the following cases: case accounting break-even unit price unit variable cost fixed costs depreciation 1 127,400 $ 38 $ 25 $ 711,000 ? 2 124,000 ? 41 2,500,000 $ 900,000 3 5,753 117 ? 171,000 100,000 required: (a) find the depreciation for case 1. (do not round your intermediate calculations.) (b) find the unit price for case 2. (do not round your intermediate calculations.) (c) find the unit variable cost for case 3. (do not round your intermediate calculations.)

Answers: 2

Business, 22.06.2019 06:40, jesh0975556

After the 2008 recession, the amount of reserves in the us banking system increased. because of federal reserve actions, required reserves increased from $44 billion to $60 billion. however, banks started holding more reserves than required. by january 2009, banks were holding $900 billion in excess reserves. the federal reserve started paying interest on the excess reserves that the banks held. what possible impact will these unused reserves have on the economy?

Answers: 1

Business, 22.06.2019 06:40, SkyMelvin

10. which of the following is true regarding preretirement inflation? a. defined-benefit plans provide more inflation protection than defined-contribution plans. b. because of preretirement inflation, possible investment-related growth is increased for defined-contribution plans. c. all types of benefits are designed to cope with preretirement inflation. d. preretirement inflation is generally reflected in the increase in an employee's compensation level over a working career.

Answers: 3

Business, 22.06.2019 07:30, mdndndndj7365

Which of the following best describes why you need to establish goals for your program?

Answers: 3

Do you know the correct answer?

You need a loan of ​$140,000 to buy a home. Calculate your monthly payments and total closing cost...

Questions in other subjects:

Mathematics, 21.03.2021 21:10

Spanish, 21.03.2021 21:10

Mathematics, 21.03.2021 21:10

Mathematics, 21.03.2021 21:10

Social Studies, 21.03.2021 21:10

Mathematics, 21.03.2021 21:10

Mathematics, 21.03.2021 21:10