Business, 06.04.2020 19:48, cluchmasters5634

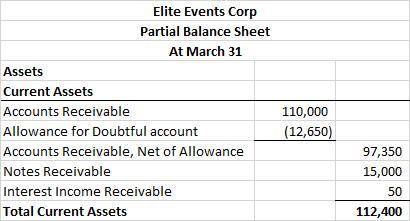

Show how Accounts Receivable, Notes Receivable, and their related accounts would be reported in the current assets section of a classified balance sheet at the end of the quarter on March 31.

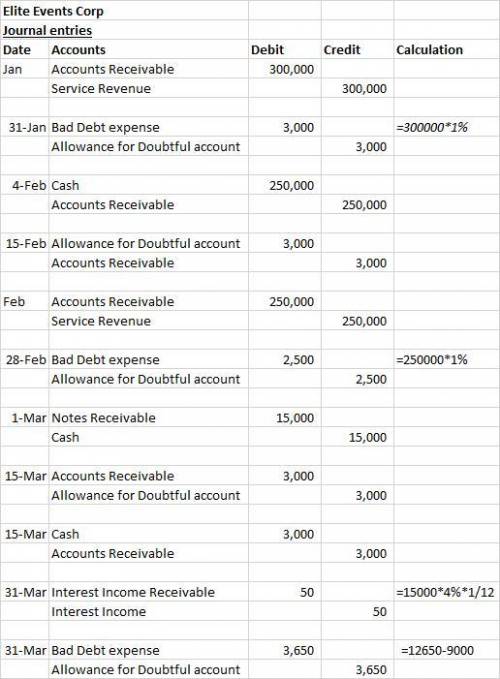

a. During January, the company provided services for $300,000 on credit.

b. On January 31, the company estimated bad debts using 1 percent of credit sales.

c. On February 4, the company collected $250,000 of accounts receivable.

d. On February 15, the company wrote off a $3,000 account receivable.

e. During February, the company provided services for $250,000 on credit.

f. On February 28, the company estimated bad debts using 1 percent of credit sales.

g. On March 1, the company loaned $15,000 to an employee who signed a 4% note, due in 9 months.

h. On March 15, the company collected $3,000 on the account written off one month earlier.

i. On March 31, the company accrued interest earned on the note.

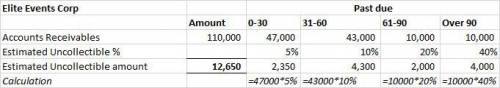

j. On March 31, the company adjusted for uncollectible accounts, based on the following aging analysis, which includes the preceding transactions (as well as others not listed). Prior to the adjustment, Allowance for Doubtful Accounts had an unadjusted credit balance of $9,000.

Number of Days Unpaid

Customer Total 0-30 31-60 61-90 Over 90

Aerosmith $ 2,000 1,000 1,000

Biggie Small 2,000 1,000 1,000

Others (not shown to save space)99,000 39,000 42,000 9,000 9,000

ZZ Top 7,000 7,000

Total Accounts Receivable $110,000 $47,000 $43,000 $10,000 $10,000

Estimated uncollectible (%) 5% 10% 20% 40%

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 20:00, 2965276513

Afirm is producing at minimum average total cost with its current plant. draw the firm's long-run average cost curve. label it. draw a point on the lrac curve at which the firm cannot lower its average total cost. draw the firm's short-run average total cost curve that is consistent with the point you have drawn. label it. g

Answers: 2

Business, 23.06.2019 08:20, vhuyrtyy

You are a newspaper publisher. you are in the middle of a one-year rental contract for your factory that requires you to pay $500,000 per month, and you have contractual labor obligations of $1 million per month that you can't get out of. you also have a marginal printing cost of $.25 per paper as well as a marginal delivery cost of $.10 per paper. if sales fall by 20 percent from 1 million papers per month to 800,000 papers per month, what happens to the afc per paper?

Answers: 2

Business, 23.06.2019 12:00, aliciagore

Rich is researching for an economics paper on the history of exchange rates between the us and great britain. the best choice for rich to use is

Answers: 3

Business, 23.06.2019 13:30, josmanu235

Everfi module 5 answers when planning for college, you should consider:

Answers: 3

Do you know the correct answer?

Show how Accounts Receivable, Notes Receivable, and their related accounts would be reported in the...

Questions in other subjects:

English, 30.01.2020 19:02

Mathematics, 30.01.2020 19:02

Biology, 30.01.2020 19:02

Social Studies, 30.01.2020 19:02

Mathematics, 30.01.2020 19:02