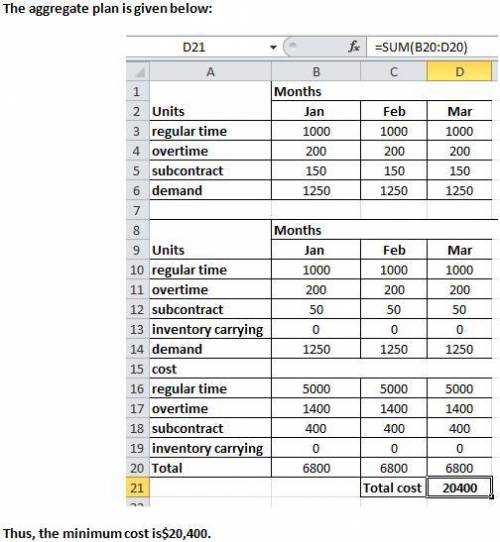

Consider the following aggregate planning problem for one quarter: Regular Time Overtime Subcontracting Production Capacity/Month 1,000 200 150 Production Cost/Month 5 7 8 Assume that there is no initial inventory and there is forecasted demand of 1,250 units in each month in the quarter. Carrying cost is $1 per unit per month, and backlogs are not allowed. Use the transportation model to find the optimal solution. How much excess capacity is there? units What is the cost of the optimal solution? How many units are actually made by subcontracting? How many units incur a holding cost? In other words, how many are made in one month and held to meet the demand of a future month? units

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 14:40, LilBrookilyn2701

Which website did you use to find the image you used in your career presentation? complete sentences are not necessary.

Answers: 1

Business, 21.06.2019 16:10, georgesarkes12

Weber company purchases $44,270 of raw materials on account, and it incurs $52,730 of factory labor costs. supporting records show that (a) the assembly department used $27,580 of raw materials and $33,320 of the factory labor, and (b) the finishing department used the remainder. manufacturing overhead is assigned to departments on the basis of 150% of labor costs. journalize the assignment of overhead to the assembly and finishing departments. account titles and explanation debit credit

Answers: 2

Business, 21.06.2019 20:30, jcotto3644

What do economists mean when they use the latin expression ceteris paribus?

Answers: 3

Business, 22.06.2019 02:00, raylynnreece4939

Precision dyes is analyzing two machines to determine which one it should purchase. the company requires a rate of return of 15 percent and uses straight-line depreciation to a zero book value over the life of its equipment. ignore bonus depreciation. machine a has a cost of $462,000, annual aftertax cash outflows of $46,200, and a four-year life. machine b costs $898,000, has annual aftertax cash outflows of $16,500, and has a seven-year life. whichever machine is purchased will be replaced at the end of its useful life. which machine should the company purchase and how much less is that machine's eac as compared to the other machine's

Answers: 3

Do you know the correct answer?

Consider the following aggregate planning problem for one quarter: Regular Time Overtime Subcontract...

Questions in other subjects:

Biology, 30.01.2020 20:58

Mathematics, 30.01.2020 20:58

History, 30.01.2020 20:58

Geography, 30.01.2020 20:58

Mathematics, 30.01.2020 20:58

Mathematics, 30.01.2020 20:58