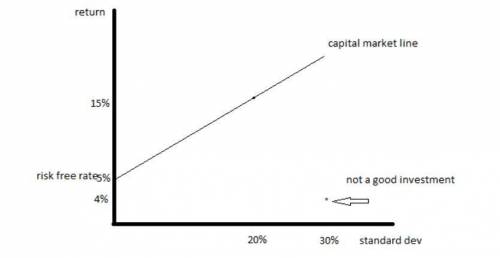

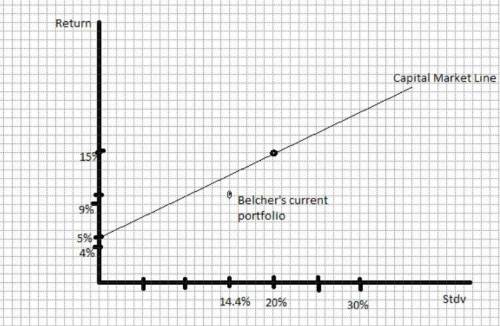

For all parts of this question, assume the following: The CAPM holds. The riskless rate of return is 5%. The market portfolio has expected rate of return of 15% and standard deviation of 20%. 1. Burger Inc. stock has an expected rate of return of 4% per year and standard deviation of 30%. Linda Belcher says, "No rational person would hold a risky asset expected to return less than the riskless rate! It must be mispriced." Is Linda correct? Explain. 2. Consider the following data on two stocks whose returns have a correlation of 0.2 with each other: Expected Return Standard Deviation Walmart 5% 12% Tesla 20% 35% Bob Belcher owns $25,000 worth of Walmart stock, $10,000 worth of Tesla stock, and no other investments. a) Compute expected rate of return (% per year), and standard deviation of Bob’s portfolio. b) Mr. Belcher says he cannot tolerate any more standard deviation than her portfolio has now. Given this risk tolerance, is he maximizing her expected return? If he is, explain why? If he is not, explain how she should invest to maximize expected return (give a specific trading and investment strategy).

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 17:30, beelcypher

Being an expert problem solver is something you're either born with or not. true or false

Answers: 2

Business, 22.06.2019 11:10, allieallie

Use the information below to answer the following question. the boxwood company sells blankets for $60 each. the following was taken from the inventory records during may. the company had no beginning inventory on may 1. date blankets units cost may 3 purchase 5 $20 10 sale 3 17 purchase 10 $24 20 sale 6 23 sale 3 30 purchase 10 $30 assuming that the company uses the perpetual inventory system, determine the gross profit for the month of may using the lifo cost method.

Answers: 1

Business, 22.06.2019 11:40, taylor825066

Define the marginal rate of substitution between two goods (x and y). if a consumer’s preferences are given by u(x, y) = x3/4y1/4, compute the consumer’s marginal rate of substitution as a function of x and y. calculate the mrs if the consumer has chosen to consumer 48 units of x and 16 units of y. show your work. (use the back of the page if necessary.

Answers: 3

Business, 22.06.2019 11:40, derrion67

During 2016, nike inc., reported net income of $3,760 million. the company declared dividends of $1,022 million. the closing entry for dividends would include which of the following? select one: a. credit cash for $1,022 million b. credit dividends for $1,022 million c. debit net income for $1,022 million d. credit retained earnings for $1,022 million e. debit dividends for $1,022 million

Answers: 1

Do you know the correct answer?

For all parts of this question, assume the following: The CAPM holds. The riskless rate of return is...

Questions in other subjects:

Computers and Technology, 03.06.2021 17:20

Mathematics, 03.06.2021 17:20

Mathematics, 03.06.2021 17:20

English, 03.06.2021 17:20

Health, 03.06.2021 17:20

Mathematics, 03.06.2021 17:20