Business, 02.04.2020 19:00, arguellesjavier15

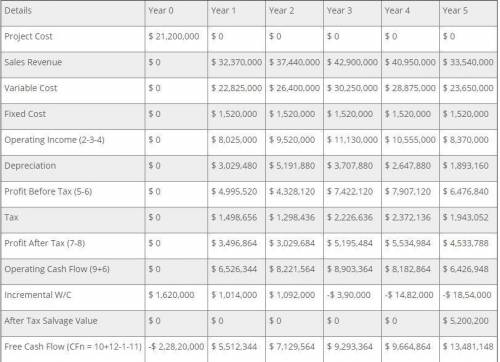

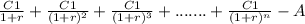

Aria Acoustics, Inc. (AAI), projects unit sales for a new seven-octave voice emulation implant as follows:

Year Unit Sales

1 73,000

2 86,000

3 105,000

4 97,000

5 67,000

Production of the implants will require $1,500,000 in net working capital to start and additional net working capital investments each year equal to 15 percent of the projected sales increase for the following year. Total fixed costs are $3,200,000 per year, variable production costs are $255 per unit, and the units are priced at $375 each. The equipment needed to begin production has an installed cost of $16,500,000. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus qualifies as seven-year MACRS property (MACRS schedule). In five years, this equipment can be sold for about 20 percent of its acquisition cost. The tax rate is 21 percent tax and the required return is 18 percent.

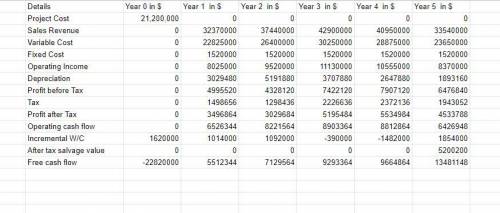

a. What is the NPV of the project?b. What is the IRR?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 01:30, hollymay808p0t9to

At the end of the week, carla receives her paycheck and goes directly to the bank after work to make a deposit into her savings account. the bank keeps the required reserve and then loans out the remaining balance to a qualified borrower named malik as a portion of his small business loan. malik uses the loan to buy a tractor for his construction business and makes small monthly payments to the bank to payback the principal balance plus interest on the loan. the bank profits from a portion of the interest payment received and also passes some of the interest back to carla in the form of an interest payment to her savings account. in this example, the bank is acting

Answers: 1

Business, 22.06.2019 08:30, cyaransteenberg

Blank is the internal operation that arranges information resources to support business performance and outcomes

Answers: 2

Business, 22.06.2019 19:20, IrieBoy7584

Why is following an unrelated diversification strategy especially advantageous in an emerging economy? a. it allows the conglomerate to overcome institutional weaknesses in emerging economies. b. it allows the conglomerate to form a monopoly in emerging economies. c. it allows the conglomerate to use well-defined legal systems in emerging economies. d. it allows the conglomerate to take advantage of strong capital markets in emerging economies.

Answers: 1

Business, 22.06.2019 21:00, liamgreene90

You have $5,300 to deposit. regency bank offers 6 percent per year compounded monthly (.5 percent per month), while king bank offers 6 percent but will only compounded annually. how much will your investment be worth in 17 years at each bank

Answers: 3

Do you know the correct answer?

Aria Acoustics, Inc. (AAI), projects unit sales for a new seven-octave voice emulation implant as fo...

Questions in other subjects:

Mathematics, 20.05.2021 23:00

Mathematics, 20.05.2021 23:00