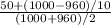

Let's say you buy a bond with a face value of $1,000 and a coupon rate of 5%, so the annual interest payments are $50. The bond matures in 10 years, but the issuer can call the bond for $1,050 in two years if they choose. You buy the bond for $960, a discount to face value. What is the yield to call (i. e., YTC)

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 07:10, Derienw6586

Walsh company manufactures and sells one product. the following information pertains to each of the company’s first two years of operations: variable costs per unit: manufacturing: direct materials $ 25 direct labor $ 12 variable manufacturing overhead $ 5 variable selling and administrative $ 4 fixed costs per year: fixed manufacturing overhead $ 400,000 fixed selling and administrative expenses $ 60,000 during its first year of operations, walsh produced 50,000 units and sold 40,000 units. during its second year of operations, it produced 40,000 units and sold 50,000 units. the selling price of the company’s product is $83 per unit. required: 1. assume the company uses variable costing: a. compute the unit product cost for year 1 and year 2. b. prepare an income statement for year 1 and year 2. 2. assume the company uses absorption costing: a. compute the unit product cost for year 1 and year 2. b. prepare an income statement for year 1 and year 2. 3. reconcile the difference between variable costing and absorption costing net operating income in year 1.

Answers: 3

Business, 23.06.2019 00:20, wwesuplexcity28

E11-2 (multiple choice) identify the best answer for each of the following: which of the following statements about internal service fund liabilities is false? internal service funds may report both current and long-term liabilities. internal service funds may not issue bonds for financing purposes. internal service funds may report contingent liabilities. due to other funds would be reported as a current liability

Answers: 3

Business, 23.06.2019 00:30, evryday2285

Three years ago, the city of recker committed to build a park and music venue by the river. it was expected to cost $2.5 million and be paid for from an additional meals tax in the community. the residents pushed back. local restaurants suffered as people ate out less or patronized restaurants in neighboring communities. the project has stalled, but the town council kept pushing it on. this spring, a flood devastated the venue. the town council appears to have suffered from bias

Answers: 3

Business, 23.06.2019 01:00, bugsbunny27

Weekly sales at nancy's restaurant total $ 84,000. labor required is 420 hours at a cost of $21,000. raw materials used amount to $40,000. what is the partial measure of productivity for labor hours?

Answers: 1

Do you know the correct answer?

Let's say you buy a bond with a face value of $1,000 and a coupon rate of 5%, so the annual interest...

Questions in other subjects:

English, 05.11.2019 03:31

Physics, 05.11.2019 03:31

Mathematics, 05.11.2019 03:31

Mathematics, 05.11.2019 03:31

Mathematics, 05.11.2019 03:31