Business, 02.04.2020 02:35, Jazmineboo5818

Magna Charter has been asked to operate a Beaver bush plane for a mining company exploring north and west of Fort Liard. Magna will have a firm 1-year contract with the mining company and expects that the contract will be renewed for the 7-year duration of the exploration program. Magna has the following choices:

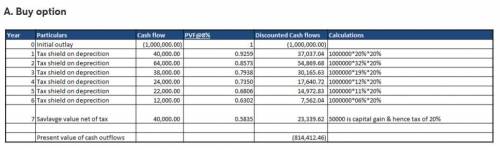

A. Purchase a plane for $1,000,000

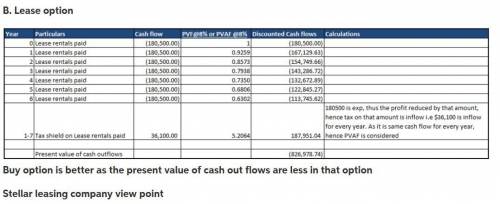

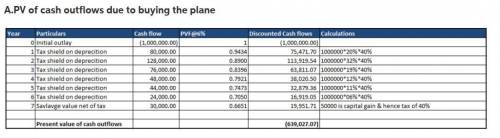

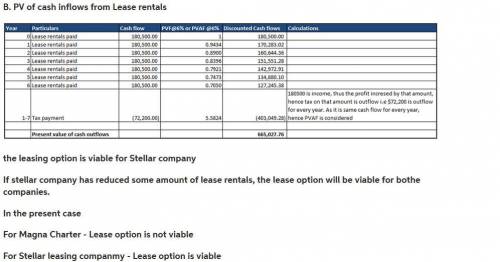

B. Arrange for a 7-year operating lease from Stellar Leasing Company. Maintenance and insurance will be borne by Magna.

Lease payments will be of equal amounts each year, and due in advance at the beginning of each year. The plane falls in the 5-year class with respect to depreciation under the MACRS. Accordingly, the depreciation percentages are 20%, 32%, 19%, 12%, 11% and 6% respectively. The salvage value at the end of 7 years is estimated at $50,000. Magna’s pre-tax cost of debt is 10%. Magna has large tax-loss carry forwards; however, owing to AMT (Alternative Minimum Tax) provisions, its expected marginal tax rate is 20%. Stellar Leasing Co., on the other hand , is a highly profitable company and faces a marginal tax rate of 40%. Stellar can earn a pre-tax rate of return of 10% on investments of similar risk.

a. Evaluate the lease from the point of view of both Magna and Stellar assuming that the lease payment is $180,500. What is the range of lease payment that would acceptable from the Lessee and the Lessor’s view point.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 19:20, Gabby2581

Win goods inc. is a large multinational conglomerate. as a single business unit, the company's stock price is estimated to be $200. however, by adding the actual market stock prices of each of its individual business units, the stock price of the company as one unit would be $300. what is win goods experiencing in this scenario? a. diversification discount b. learning-curveeffects c. experience-curveeffects d. economies of scale

Answers: 1

Business, 22.06.2019 19:30, Wayne4345

John's pizzeria and equilibrium john is selling his pizza for $6 per slice in an area of high demand. however, customers are not buying his pizza. using what you learned about the principles of equilibrium, write three to four sentences about how john could solve his problem.

Answers: 1

Business, 22.06.2019 19:40, Animallover100

Best burger is a major fast food chain. its managers are motivated to grow the firm in order to increase their market power and change the industry structure in their favor. which of the following strategies is most associated with their motive for growth? a. employing celebrity spokespeople b. implementing automated burger-making machinery c. purchasing competitors d. increasing executive salaries

Answers: 3

Business, 23.06.2019 00:00, ldelgado97

Wo firms, a and b, each currently dump 50 tons of chemicals into the local river. the government has decided to reduce the pollution and from now on will require a pollution permit for each ton of pollution dumped into the river. it costs firm a $100 for each ton of pollution that it eliminates before it reaches the river, and it costs firm b $50 for each ton of pollution that it eliminates before it reaches the river. the government gives each firm 20 pollution permits. government officials are not sure whether to allow the firms to buy or sell the pollution permits to each other. what is the total cost of reducing pollution if firms are not allowed to buy and sell pollution permits from each other? what is the total cost of reducing pollution if the firms are allowed to buy and sell permits from each other? a. $3,000; $1,500 b. $4,500; $3,500 c. $4,500; $4,000 d. $4,500; $2,500

Answers: 3

Do you know the correct answer?

Magna Charter has been asked to operate a Beaver bush plane for a mining company exploring north and...

Questions in other subjects:

Mathematics, 13.09.2021 17:40

Mathematics, 13.09.2021 17:40

English, 13.09.2021 17:40

Mathematics, 13.09.2021 17:40

Mathematics, 13.09.2021 17:40