Business, 31.03.2020 03:28, sarahmckee69

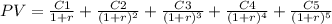

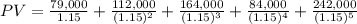

Nutech Corp. is expecting the following cash flows—$79,000, $112,000, $164,000, $84,000, and $242,000—over the next five years. If the company’s opportunity cost of capital is 15 percent, what is the present value of these cash flows? (Round to the nearest dollar.)

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 16:30, lishalarrickougdzr

ernst's electrical has a bond issue outstanding with ten years to maturity. these bonds have a $1,000 face value, a 5 percent coupon, and pay interest semiminusannually. the bonds are currently quoted at 96 percent of face value. what is ernst's pretax cost of debt?

Answers: 1

Business, 22.06.2019 08:30, labrandonanderson00

What is the equity method balance in the investment in lindman account at the end of 2018?

Answers: 2

Business, 22.06.2019 11:40, derrion67

During 2016, nike inc., reported net income of $3,760 million. the company declared dividends of $1,022 million. the closing entry for dividends would include which of the following? select one: a. credit cash for $1,022 million b. credit dividends for $1,022 million c. debit net income for $1,022 million d. credit retained earnings for $1,022 million e. debit dividends for $1,022 million

Answers: 1

Do you know the correct answer?

Nutech Corp. is expecting the following cash flows—$79,000, $112,000, $164,000, $84,000, and $242,00...

Questions in other subjects:

History, 21.09.2021 18:40

Mathematics, 21.09.2021 18:40

Mathematics, 21.09.2021 18:40

Mathematics, 21.09.2021 18:40

Mathematics, 21.09.2021 18:40