Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 10:30, Uc34758

Issued to the joint planning and execution community (jpec) initiates the development of coas; it also requests that the supported ccdr submit a commander's estimate of the situation with a recommended coa to resolve the situation (joint force command and staff participation in the joint operation planning and execution system, page 10)

Answers: 2

Business, 22.06.2019 14:40, smithnakayla19

Increases in output and increases in the inflation rate have been linked to

Answers: 2

Do you know the correct answer?

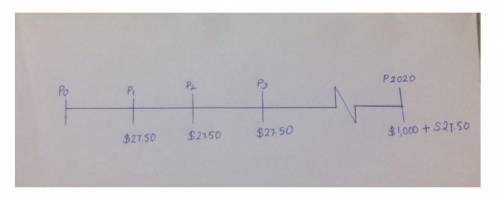

Consider a 10-year bond with a face value of $ 1 comma 000 that has a coupon rate of 5.1 %, with sem...

Questions in other subjects:

Social Studies, 15.04.2020 19:38

Business, 15.04.2020 19:39

History, 15.04.2020 19:39