Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 23:30, Mikec123

Select the correct answer. joshua runs a large manufacturing business that is listed on the stock exchange. his company made good profits in the previous financial year. he now plans to reward his shareholders with handsome dividends. under which category of activities in the cash flow statement would the company’s accountants place this outflow of cash? a. investing activities b. operating activities c. financing activities d. non-operating activities

Answers: 3

Business, 22.06.2019 11:30, wrivera32802

Leon and sara are arguing over when the best time is to degrease soup. leon says that it's easiest to degrease soup when it's boiling. sara says it's easiest to degrease soup when it's cold. who is correct? a. neither leon nor sara is correct. b. leon is correct. c. both leon and sara are correct. d. sara is correct. student b incorrect which following answer correct?

Answers: 1

Do you know the correct answer?

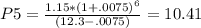

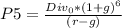

Just paid its annual dividend of $1.15 per share. The required return is 12.3 percent and the divide...

Questions in other subjects:

History, 11.01.2020 17:31

Mathematics, 11.01.2020 17:31

English, 11.01.2020 17:31

The first Dividend Paid.G = Growth Rate.R = Required Return.Given Data:

The first Dividend Paid.G = Growth Rate.R = Required Return.Given Data: