Business, 30.03.2020 19:24, bgallman153p71edg

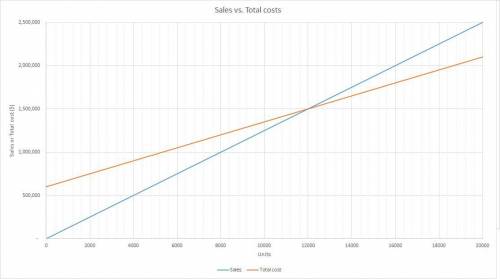

For the coming year, Loudermilk Inc. anticipates fixed costs of $600,000, a unit variable cost of $75, and a unit selling price of $125. The maximum sales within the relevant range are $2,500,000. a. Construct a cost-volume-profit chart on a sheet of paper. Indicate whether each of the following levels of sales (units or dollars) is in the operating profit area, operating loss area, or at the break-even point. 4,800 units 12,000 units $1,500,000 20,000 units $2,500,000 b. Estimate the break-even sales (dollars) by using the cost-volume-profit chart constructed in part (a). $ c. The graphic format permits the user to visually determine the and the for any given level of

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 20:30, julesperez22

In general, as long as the number of firms that possess a particular valuable resource or capability is less than the number of firms needed to generate perfect competition dynamics in an industry, that resource or capability can be considered and a potential source of competitive advantage. answers: valuablerareinimitableun-substituta ble

Answers: 1

Business, 22.06.2019 20:10, elora2007

The gilbert instrument corporation is considering replacing the wood steamer it currently uses to shape guitar sides. the steamer has 6 years of remaining life. if kept, the steamer will have depreciaiton expenses of $650 for five years and $325 for the sixthyear. its current book value is $3,575, and it can be sold on an internet auction site for$4,150 at this time. if the old steamer is not replaced, it can be sold for $800 at the endof its useful life. gilbert is considering purchasing the side steamer 3000, a higher-end steamer, whichcosts $12,000 and has an estimated useful life of 6 years with an estimated salvage value of$1,500. this steamer falls into the macrs 5-year class, so the applicable depreciationrates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76%. the new steamer is fasterand allows for an output expansion, so sales would rise by $2,000 per year; the newmachine's much greater efficiency would reduce operating expenses by $1,900 per year. to support the greater sales, the new machine would require that inventories increase by$2,900, but accounts payable would simultaneously increase by $700. gilbert's marginalfederal-plus-state tax rate is 40%, and its wacc is 15%.a. should it replace the old steamer? b. npv of replace = $2,083.51

Answers: 2

Business, 23.06.2019 03:00, drainy0uandthefish

Why is the type of product sold in an industry an important characteristic? a firm that can differentiate its product from that of rivals may be able to charge a higher price for a superior product. a firm that sells intangible goods is usually considered a monopoly. service industries cannot differentiate their products, which makes it easy for new firms to enter the industry. expensive products are usually sold by perfectly competitive firms.

Answers: 2

Do you know the correct answer?

For the coming year, Loudermilk Inc. anticipates fixed costs of $600,000, a unit variable cost of $7...

Questions in other subjects:

Mathematics, 05.02.2021 22:40

Arts, 05.02.2021 22:40

Mathematics, 05.02.2021 22:40

History, 05.02.2021 22:40

Physics, 05.02.2021 22:40

English, 05.02.2021 22:40

Biology, 05.02.2021 22:40