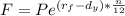

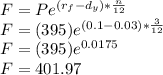

Suppose that the risk-free interest rate is 10% per annum with continuous compounding and that the dividend yield on a stock index is 3% per annum. The index is standing at 395, and the futures price for a contract deliverable in three months is 404.

What arbitrage opportunities does this create?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 10:00, annafellows

Cynthia is a hospitality worker in the lodging industry who prefers to cater to small groups of people. she might want to open a

Answers: 3

Business, 22.06.2019 10:10, travisvb

Ursus, inc., is considering a project that would have a five-year life and would require a $1,650,000 investment in equipment. at the end of five years, the project would terminate and the equipment would have no salvage value. the project would provide net operating income each year as follows (ignore income taxes.):

Answers: 1

Business, 22.06.2019 14:50, 2020EIglesias180

Pederson company reported the following: manufacturing costs $480,000 units manufactured 8,000 units sold 7,500 units sold for $90 per unit beginning inventory 2,000 units what is the average manufacturing cost per unit? (round the answer to the nearest dollar.)

Answers: 3

Do you know the correct answer?

Suppose that the risk-free interest rate is 10% per annum with continuous compounding and that the d...

Questions in other subjects:

Mathematics, 04.12.2021 01:10

Computers and Technology, 04.12.2021 01:10

Health, 04.12.2021 01:10

Mathematics, 04.12.2021 01:10

English, 04.12.2021 01:10

Computers and Technology, 04.12.2021 01:10

Biology, 04.12.2021 01:10