Business, 27.03.2020 22:04, preciosakassidy

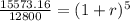

Finding the interest rate and the number of years The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future value calculations. If a security currently worth $12,800 will be worth $15,573.16 five years in the future, what is the implied interest rate the investor will earn on the security-assuming that no additional deposits or withdrawals are made?

a. 3.20%

b. 0.24%

c. 1.22%

d. 4.00% for this investment to reach

If an investment of $35,000 is earning an interest rate of 8.00%, compounded annually, then it will take a value of $44,089.92-assuming that no additional deposits or withdrawals are made during this time. Which of the following statements is true-assuming that no additional deposits or withdrawals are made?

a. If you invest $1 today at 15% annual compound interest for 82.3753 years, you'll end up with $100,000.

b. If you invest $5 today at 15% annual compound interest for 82.3753 years, you'll end up with $100,000

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 00:10, wolfycatsz74

Which of the following is a problem for the production of public goods?

Answers: 2

Business, 22.06.2019 03:00, rafa3997

Fanning books buys books and magazines directly from publishers and distributes them to grocery stores. the wholesaler expects to purchase the following inventory: april may june required purchases (on account) $ 111,000 $ 131,000 $ 143,000 fanning books accountant prepared the following schedule of cash payments for inventory purchases. fanning books suppliers require that 85 percent of purchases on account be paid in the month of purchase; the remaining 15 percent are paid in the month following the month of purchase. required complete the schedule of cash payments for inventory purchases by filling in the missing amounts. determine the amount of accounts payable the company will report on its pro forma balance sheet at the end of the second quarter.

Answers: 2

Business, 22.06.2019 11:40, rmcarde4432

Fanning company is considering the addition of a new product to its cosmetics line. the company has three distinctly different options: a skin cream, a bath oil, or a hair coloring gel. relevant information and budgeted annual income statements for each of the products follow. skin cream bath oil color gel budgeted sales in units (a) 110,000 190,000 70,000 expected sales price (b) $8 $4 $11 variable costs per unit (c) $2 $2 $7 income statements sales revenue (a × b) $880,000 $760,000 $770,000 variable costs (a × c) (220,000) (380,000) (490,000) contribution margin 660,000 380,000 280,000 fixed costs (432,000) (240,000) (76,000) net income $228,000 $140,000 $204,000 required: (a) determine the margin of safety as a percentage for each product. (b) prepare revised income statements for each product, assuming a 20 percent increase in the budgeted sales volume. (c) for each product, determine the percentage change in net income that results from the 20 percent increase in sales. (d) assuming that management is pessimistic and risk averse, which product should the company add to its cosmetics line? (e) assuming that management is optimistic and risk aggressive, which product should the company add to its cosmetics line?

Answers: 1

Business, 22.06.2019 16:00, winstonbendariovvygn

If the family’s net monthly income is 7,800 what percent of the income is spent on food clothing and housing?

Answers: 3

Do you know the correct answer?

Finding the interest rate and the number of years The future value and present value equations also...

Questions in other subjects:

Mathematics, 11.10.2019 18:30

Mathematics, 11.10.2019 18:30

Mathematics, 11.10.2019 18:30

Mathematics, 11.10.2019 18:30

Mathematics, 11.10.2019 18:30

* 100 = 4.00%

* 100 = 4.00%