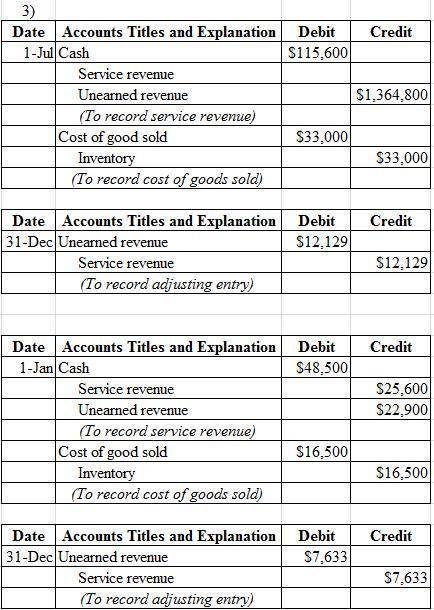

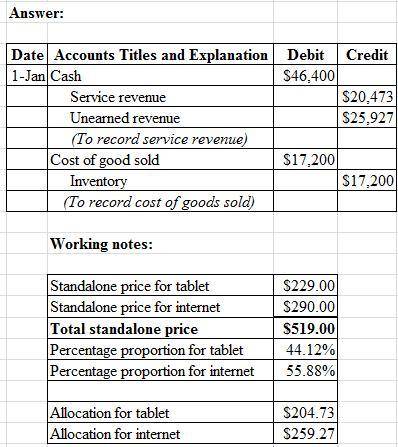

Monty Company sells tablet PCs combined with Internet service, which permits the tablet to connect to the Internet anywhere and set up a Wi-Fi hot spot. It offers two bundles with the following terms.1.Monty Bundle A sells a tablet with 3 years of Internet service. The price for the tablet and a 3-year Internet connection service contract is $464. The standalone selling price of the tablet is $229 (the cost to Monty Company is $172). Monty Company sells the Internet access service independently for an upfront payment of $290. On January 2, 2017, Monty Company signed 100 contracts, receiving a total of $46,400 in cash.2.Monty Bundle B includes the tablet and Internet service plus a service plan for the tablet PC (for any repairs or upgrades to the tablet or the Internet connections) during the 3-year contract period. That product bundle sells for $563. Monty Company provides the 3-year tablet service plan as a separate product with a standalone selling price of $154. Monty Company signed 190 contracts for Monty Bundle B on July 1, 2017, receiving a total of $106,970 in cash. a. Prepare any journal entries to record the revenue arrangement for Monty Bundle A on January 2, 2017, and December 31, 2017DateAccount Titles and . 2, 2017Jul. 1, 2017Dec. 31, 2017(To record sales)(To record cost of goods sold)Jan. 2, 2017Jul. 1, 2017Dec. 31, 2017b. Prepare any journal entries to record the revenue arrangement for Monty Bundle B on July 1, 2017, and December 31, 2017.DateAccount Titles and . 2, 2017Jul. 1, 2017Dec. 31, 2017(To record sales)(To record cost of goods sold)Dec. 31, 2017c. Repeat the requirements for part (a), assuming that Monty Company has no reliable data with which to estimate the standalone selling price for the Internet serviceDateAccount Titles and . 2, 2017Jul. 1, 2017Dec. 31, 2017(To record sales)(To record cost of goods sold)Jan. 2, 2017Jul. 1, 2017Dec. 31, 2017

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 08:00, kingyogii

Suppose that xtel currently is selling at $40 per share. you buy 500 shares using $15,000 of your own money, borrowing the remainder of the purchase price from your broker. the rate on the margin loan is 8%. a. what is the percentage increase in the net worth of your brokerage account if the price of xtel immediately changes to (a) $44; (b) $40; (c) $36? (leave no cells blank - be certain to enter "0" wherever required. negative values should be indicated by a minus sign. round your answers to 2 decimal places.) b. if the maintenance margin is 25%, how low can xtel’s price fall before you get a margin call? (round your answer to 2 decimal places.) c. how would your answer to requirement 2 would change if you had financed the initial purchase with only $10,000 of your own money? (round your answer to 2 decimal places.) d. what is the rate of return on your margined position (assuming again that you invest $15,000 of your own money) if xtel is selling after one year at (a) $44; (b) $40; (c) $36? (negative values should be indicated by a minus sign. round your answers to 2 decimal places.) e. continue to assume that a year has passed. how low can xtel’s price fall before you get a margin call? (round your answer to 2 decimal places.)

Answers: 1

Business, 22.06.2019 17:30, brittanyjacob8

Kevin and jenny, who are both working full-time, have three children all under the age of ten. the two youngest children, who are three and five years old, attended eastside pre-school for a total cost of $3,000. ervin, who is nine, attended big kid daycare after school at a cost of $2,000. jenny has earned income of $15,000 and kevin earns $14,000. what amount of childcare expenses should be used to determine the child and dependent care credit?

Answers: 3

Business, 22.06.2019 21:00, sofiaisabelaguozdpez

Roberto and reagan are both 25 percent owner/managers for bright light inc. roberto runs the retail store in sacramento, ca, and reagan runs the retail store in san francisco, ca. bright light inc. generated a $125,000 profit companywide made up of a $75,000 profit from the sacramento store, a ($25,000) loss from the san francisco store, and a combined $75,000 profit from the remaining stores. if bright light inc. is an s corporation, how much income will be allocated to roberto?

Answers: 2

Business, 22.06.2019 22:40, jonlandis6

The year is 2278, and the starship enterprise is running low on dilithium crystals, which are used to regulate the matter-antimatter reactions that propel the ship across the universe. without the crystals, space-time travel is not possible. if there is only one known source of dilithium crystals, the necessary conditions for a monopoly are met. part 2 (1 point)see hint if the crystals are government owned or government regulated, and the government wants to create the greatest welfare for society, then it should set the price choose one or more: a. so only the rich can afford space-time travel. b. at the profit-maximizing price. c. at the efficient price. d. using the marginal-cost pricing rule. e. so everyone can afford space-time travel. f. at the monopoly price.

Answers: 1

Do you know the correct answer?

Monty Company sells tablet PCs combined with Internet service, which permits the tablet to connect t...

Questions in other subjects:

Advanced Placement (AP), 12.05.2021 04:40

Mathematics, 12.05.2021 04:40

Mathematics, 12.05.2021 04:40

English, 12.05.2021 04:40

English, 12.05.2021 04:40

English, 12.05.2021 04:40