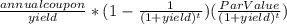

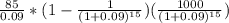

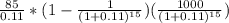

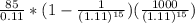

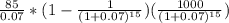

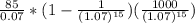

(Bond valuation relationships) Stanley, Inc. issues 15-year $1 comma 000 bonds that pay $85 annually. The market price for the bonds is $960. The market's required yield to maturity on a comparable-risk bond is 9 percent. a. What is the value of the bond to you? b. What happens to the value if the market's required yield to maturity on a comparable-risk bond (i) increases to 11 percent or (ii) decreases to 7 percent? c. Under which of the circumstances in part b should you purchase the bond? a. What is the value of the bond if the market's required yield to maturity on a comparable-risk bond is 9 percent?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 10:30, tigistamare03

6carla would like to buy a dress, a dresser for her bedroom, and a home theater system. she has one month's worth of living expenses in her emergency fund. carla decides to save for the home theater system. did carla make the right decision? why or why not? a. yes; her emergency fund is full and the other items will probably be less expensive. b. yes; she could save more for her emergency fund, but the home theater will be harder to save for. c. no; she should save more for her emergency fund because she has saved less than the recommended amount. d. no; she should have bought the dress and dresser first because she could afford them right away. reset next

Answers: 2

Business, 22.06.2019 16:00, knownperson233

In macroeconomics, to study the aggregate means to study blank

Answers: 1

Business, 22.06.2019 22:30, chad65

Which of the following situations is most likely to change a buyer's market into a seller's market? a. a natural disaster that drives away a lot of the population. b. the price of building materials suddenly going up. c. the government buys up a lot of houses to build a new freeway. d. a factory laying off a lot of workers in the area.

Answers: 1

Business, 22.06.2019 23:00, ehthaboe7265

Consider a consumer who is contemplating a new automobile purchase. she has narrowed her decision down to two brands, honda accord and ford taurus. she has identified gas mileage, price, warranty, and styling to be important attributes to consider in her decision

Answers: 1

Do you know the correct answer?

(Bond valuation relationships) Stanley, Inc. issues 15-year $1 comma 000 bonds that pay $85 annually...

Questions in other subjects:

English, 15.02.2021 06:30

Mathematics, 15.02.2021 06:30

Mathematics, 15.02.2021 06:30

Biology, 15.02.2021 06:30