$1,000 par value zero-coupon bonds (ignore liquidity premiums).

Bond Years to Maturity Y...

Business, 24.03.2020 02:49, mmimay3501

$1,000 par value zero-coupon bonds (ignore liquidity premiums).

Bond Years to Maturity Yield to Maturity

A 1 6.00%

B 2 7.50%

C 3 7.99%

D 4 8.49%

E 5 10.70%

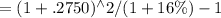

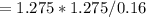

The expected 1-year interest rate 1 years from now should be

a. 6%

b. 7.5%

c. 9.02%

d. 10.70%

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 11:20, tatilynnsoto17

Ardmore farm and seed has an inventory dilemma. they have been selling a brand of very popular insect spray for the past year. they have never really analyzed the costs incurred from ordering and holding the inventory and currently fave a large stock of the insecticide in the warehouse. they estimate that it costs $25 to place an order, and it costs $0.25 per gallon to hold the spray. the annual requirements total 80,000 gallons for a 365 day year. a. assuming that 10,000 gallons are ordered each time an order is placed, estimate the annual inventory costs. b. calculate the eoq. c. given the eoq calculated in part b., how many orders should be placed and what is the average inventory balance? d. if it takes seven days to receive an order from suppliers, at what inventory level should ardmore place another order?

Answers: 2

Business, 22.06.2019 15:30, thall5026

Calculate the required rate of return for climax inc., assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) the firm has a beta of 2.30, and (5) its realized rate of return has averaged 15.0% over the last 5 years. do not round your intermediate calculations.

Answers: 3

Business, 22.06.2019 17:30, chrisd2432

Alinguist had a gross income of 53,350 last year. if 17.9% of his income got witheld for federal income tax, how much of the linguist's pay got witheld for federal income tax last year?

Answers: 2

Business, 22.06.2019 21:20, haileymaree

1. what are the unique operational challenges to delivering fresh meals? 2. why is speed of delivery so important for delivered meals? what variety of options contribute to this performance metric? 3. how could operations management concepts be utilized to improve the performance of freshly? 4. what are your typical product delivery times? what would be required to speed these up? 5. what are your delivery batch quantities? how could you reduce batch size and reduce delivery cost simultaneously using operations management concepts?

Answers: 2

Do you know the correct answer?

Questions in other subjects:

Mathematics, 19.09.2021 19:40

Mathematics, 19.09.2021 19:40

History, 19.09.2021 19:40

Biology, 19.09.2021 19:40

Mathematics, 19.09.2021 19:40