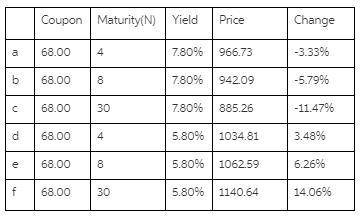

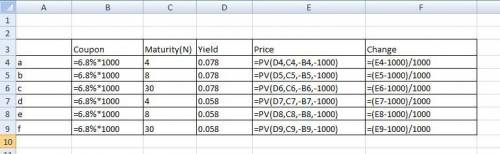

Consider three bonds with 6.80% coupon rates, all making annual coupon payments and all selling at face value. The short-term bond has a maturity of 4 years, the intermediate-term bond has a maturity of 8 years, and the long-term bond has a maturity of 30 years.

a. What will be the price of the 4-year bond if its yield increases to 7.80%? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

b. What will be the price of the 8-year bond if its yield increases to 7.80%? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

c. What will be the price of the 30-year bond if its yield increases to 7.80%? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

d. What will be the price of the 4-year bond if its yield decreases to 5.80%? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

e. What will be the price of the 8-year bond if its yield decreases to 5.80%? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

f. What will be the price of the 30-year bond if its yield decreases to 5.80%? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

g. Comparing your answers to parts (a), (b), and (c), are long-term bonds more or less affected than short-term bonds by a rise in interest rates?

More or less affected

h. Comparing your answers to parts (d), (e), and (f), are long-term bonds more or less affected than short-term bonds by a decline in interest rates?

More or less affected

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 12:30, samreitz1147

howard, fine, & howard is an advertising agency. the firm uses an activity-based costing system to allocate overhead costs to its services. information about the firm's activity cost pool rates follows: stooge company was a client of howard, fine, & howard. recently, 7 administrative assistant hours, 3 new ad campaigns, and 8 meeting hours were incurred for the stooge company account. using the activity-based costing system, how much overhead cost would be allocated to the stooge company account?

Answers: 1

Business, 22.06.2019 12:50, axelsanchez7710

You are working on a bid to build two city parks a year for the next three years. this project requires the purchase of $249,000 of equipment that will be depreciated using straight-line depreciation to a zero book value over the three-year project life. ignore bonus depreciation. the equipment can be sold at the end of the project for $115,000. you will also need $18.000 in net working capital for the duration of the project. the fixed costs will be $37000 a year and the variable costs will be $148,000 per park. your required rate of return is 14 percent and your tax rate is 21 percent. what is the minimal amount you should bid per park? (round your answer to the nearest $100) (a) $214,300 (b) $214,100 (c) $212,500 (d) $208,200 (e) $208,400

Answers: 3

Business, 22.06.2019 20:30, DrippyGanja

What could cause a production possibilities curve to move down and to the left? a.) a nation loses land after being defeated in a war. b.) an increase in the use of computer technology speeds up production c.) a baby boom 20 years ago results in a large number of young adults in the population today. d.) thousands of investors from overseas invest money in a nations economy.

Answers: 1

Business, 22.06.2019 21:50, peno211

Required: 1-a. the marketing manager argues that a $5,000 increase in the monthly advertising budget would increase monthly sales by $9,000. calculate the increase or decrease in net operating income. 1-b. should the advertising budget be increased ? yes no hintsreferencesebook & resources hint #1 check my work 8.value: 1.00 pointsrequired information 2-a. refer to the original data. management is considering using higher-quality components that would increase the variable expense by $2 per unit. the marketing manager believes that the higher-quality product would increase sales by 10% per month. calculate the change in total contribution margin. 2-b. should the higher-quality components be used? yes no

Answers: 1

Do you know the correct answer?

Consider three bonds with 6.80% coupon rates, all making annual coupon payments and all selling at f...

Questions in other subjects:

Social Studies, 30.11.2020 19:10

Mathematics, 30.11.2020 19:10

Mathematics, 30.11.2020 19:10

Arts, 30.11.2020 19:10

Health, 30.11.2020 19:10

Social Studies, 30.11.2020 19:10