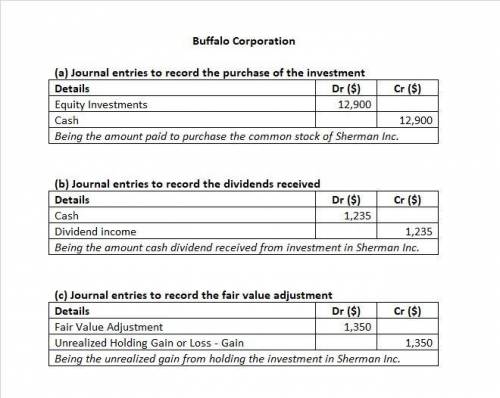

Buffalo Corporation purchased 380 shares of Sherman Inc. common stock for $12,900 (Buffalo does not have significant influence). During the year, Sherman paid a cash dividend of $3.25 per share. At year-end, Sherman stock was selling for $37.50 per share.

Prepare Buffalo's journal entries to record (a) the purchase of the investment, (b) the dividends received, and (c) the fair value adjustment.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 13:30, ayoismeisalex

On january 2, well co. purchased 10% of rea, inc.’s outstanding common shares for $400,000, which equaled the carrying amount and the fair value of the interest purchased in rea’s net assets. well did not elect the fair value option. because well is the largest single shareholder in rea, and well’s officers are a majority on rea’s board of directors, well exercises significant influence over rea. rea reported net income of $500,000 for the year and paid dividends of $150,000. in its december 31 balance sheet, what amount should well report as investment in rea?

Answers: 3

Business, 22.06.2019 20:20, gbrightwell

Reynolds corp. factors $400,000 of accounts receivable with mateer finance corporation on a without recourse basis on july 1, 2015. the receivables records are transferred to mateer finance, which will receive the collections. mateer finance assesses a finance charge of 1 ½ percent of the amount of accounts receivable and retains an amount equal to 4% of accounts receivable to cover sales discounts, returns, and allowances. the transaction is to be recorded as a sale. required: a. prepare the journal entry on july 1, 2015, for reynolds corp. to record the sale of receivables without recourse. b. prepare the journal entry on july 1, 2015, for mateer finance corporation to record the purchase of receivables without recourse— think through this. c. explain the difference between sale of receivables with recourse as oppose to without recourse.

Answers: 2

Business, 23.06.2019 02:30, naruto63

Cadillac's portfolio consists of sedans, a crossover, a sport utility vehicle, and a high-performance version of the sedan. the sedans are sold through the cadillac dealer network, but the high-performance version is sold in limited volumes and is not available at all dealers. this difference in availability is an example of how the products within the cadillac portfolio are differentiated by the

Answers: 3

Business, 23.06.2019 10:00, kayleahwilliams6

How does a business determine the markup on a product or service? by matching the closest competitor by checking online prices by calculating the profit that will keep the business going by considering how much the product is worth to the consumer

Answers: 3

Do you know the correct answer?

Buffalo Corporation purchased 380 shares of Sherman Inc. common stock for $12,900 (Buffalo does not...

Questions in other subjects:

Biology, 27.01.2021 22:30

Spanish, 27.01.2021 22:30

Mathematics, 27.01.2021 22:30

History, 27.01.2021 22:30

Computers and Technology, 27.01.2021 22:30

Mathematics, 27.01.2021 22:30

Mathematics, 27.01.2021 22:30

Biology, 27.01.2021 22:30

Mathematics, 27.01.2021 22:30