Business, 20.03.2020 10:59, danielahumajova6

Fonda Motorcycle Shop sells motorcycles, ATVs, and other related supplies and accessories. During the taking of its physical inventory on December 31, 2016, Fonda Motorcycle Shop incorrectly counted its inventory as $337,500 instead of the correct amount of $328,850.

Enter all amounts as positive numbers.

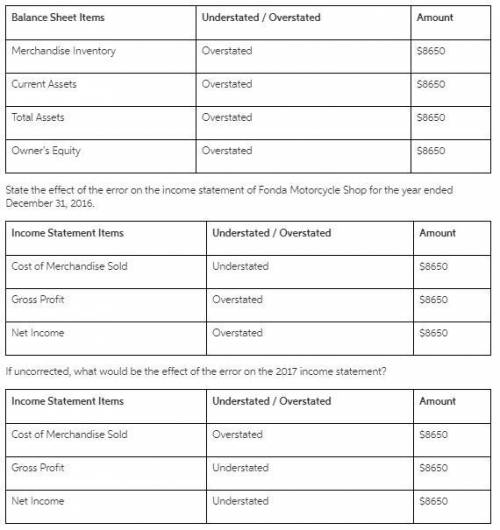

a. State the effect of the error on the December 31, 2016, balance sheet of Fonda Motorcycle Shop.

Balance Sheet Items Understated / Overstated Amount

Merchandise Inventory Overstated $

Current Assets Overstated $

Total Assets Overstated $

Owner's Equity Overstated $

b. State the effect of the error on the income statement of Fonda Motorcycle Shop for the year ended December 31, 2016.

Income Statement Items Understated / Overstated Amount

Cost of Merchandise Sold Understated $

Gross Profit Overstated $

Net Income Overstated $

c. If uncorrected, what would be the effect of the error on the 2017 income statement?

Income Statement Items Understated / Overstated Amount

Cost of Merchandise Sold Overstated $

Gross Profit Understated $

Net Income Understated $

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 02:30, maxicanofb0011

Based on the supply and demand theory, why do medical doctors earn higher wages than child-care workers?

Answers: 1

Business, 22.06.2019 12:30, samreitz1147

howard, fine, & howard is an advertising agency. the firm uses an activity-based costing system to allocate overhead costs to its services. information about the firm's activity cost pool rates follows: stooge company was a client of howard, fine, & howard. recently, 7 administrative assistant hours, 3 new ad campaigns, and 8 meeting hours were incurred for the stooge company account. using the activity-based costing system, how much overhead cost would be allocated to the stooge company account?

Answers: 1

Business, 22.06.2019 14:20, ssalusso7914

Cardinal company is considering a project that would require a $2,725,000 investment in equipment with a useful life of five years. at the end of five years, the project would terminate and the equipment would be sold for its salvage value of $400,000. the company’s discount rate is 14%. the project would provide net operating income each year as follows: sales $2,867,000 variable expenses 1,125,000 contribution margin 1,742,000 fixed expenses: advertising, salaries, and other fixed out-of-pocket costs $706,000 depreciation 465,000 total fixed expenses 1,171,000 net operating income $571,000 1. which item(s) in the income statement shown above will not affect cash flows? (you may select more than one answer. single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. any boxes left with a question mark will be automatically graded as incorrect.) (a)sales (b)variable expenses (c) advertising, salaries, and other fixed out-of-pocket costs expenses (d) depreciation expense 2. what are the project’s annual net cash inflows? 3.what is the present value of the project’s annual net cash inflows? (use the appropriate table to determine the discount factor(s) and final answer to the nearest dollar amount.) 4.what is the present value of the equipment’s salvage value at the end of five years? (use the appropriate table to determine the discount factor(s) and final answer to the nearest dollar amount.) 5.what is the project’s net present value? (use the appropriate table to determine the discount factor(s) and final answer to the nearest dollar amount.)

Answers: 2

Business, 23.06.2019 10:30, gshreya2005

Compare the rate at which each of the three students read. stew: connie: felicia: words minute 795 3 1855 7 2120 8 2650 10 260 words per minute which student reads at a faster rate? in your final answer, include all necessary calculations.

Answers: 2

Do you know the correct answer?

Fonda Motorcycle Shop sells motorcycles, ATVs, and other related supplies and accessories. During th...

Questions in other subjects:

Mathematics, 20.09.2020 04:01

Mathematics, 20.09.2020 04:01

History, 20.09.2020 04:01

History, 20.09.2020 04:01

English, 20.09.2020 04:01

Social Studies, 20.09.2020 04:01