Windsor Corp. has a deferred tax asset account with a balance of $163,880 at the end of 2016 due to a single cumulative temporary difference of $409,700. At the end of 2017, this same temporary difference has increased to a cumulative amount of $470,800. Taxable income for 2017 is $861,700. The tax rate is 40% for all years. At the end of 2016, Windsor Corp. had a valuation account related to its deferred tax asset of $44,800.

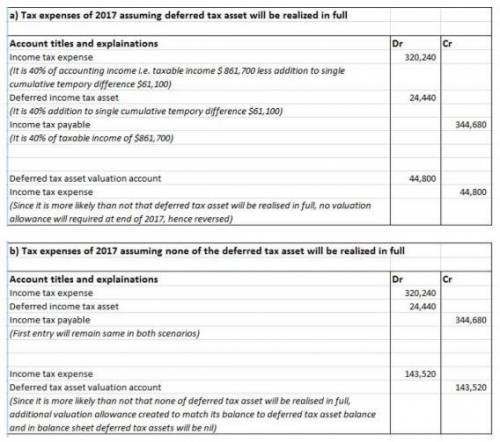

(a) Record income tax expense, deferred income taxes, and income taxes payable for 2017, assuming that it is more likely than not that the deferred tax asset will be realized in full.

(b) Record income tax expense, deferred income taxes, and income taxes payable for 2017, assuming that it is more likely than not that none of the deferred tax asset will be realized.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 21:30, angoliabirtio

The adjusted trial balance for china tea company at december 31, 2018, is presented below:

Answers: 1

Business, 22.06.2019 23:20, QueenNerdy889

You work as the sales manager for a company that sells office supplies to businesses of all sizes. because the profit margins are razor-thin, you need to ensure that you are getting the very best prices on paper, pencils, pens, post-it notes, and other office supplies from the manufacturers. when reviewing the quarterly profit statement, you realize that your costs are higher than they should be, and you trace the higher costs back to an employee who has been lax about getting competitive bids to ensure the lowest prices. when you conduct your research to determine the reason for the higher costs, and take action to bring those costs back down, in which of the key management processes are you taking part?

Answers: 3

Business, 23.06.2019 02:20, maustin5323

Which one of the following is not a typical current liability? a. interest payable b. current maturities of long-term debt c. salaries payable d. mortgages payable

Answers: 3

Do you know the correct answer?

Windsor Corp. has a deferred tax asset account with a balance of $163,880 at the end of 2016 due to...

Questions in other subjects:

English, 19.03.2020 00:38

Social Studies, 19.03.2020 00:38

History, 19.03.2020 00:38