Business, 19.03.2020 17:33, seider7997

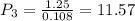

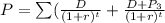

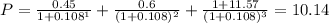

5. Renew It, Inc, is preparing to pay its first dividend. It is going to pay $0.45, $0.60, and $1 a share over the next three years, respectively. After that, the company has stated that the annual dividend will be $1.25 per share indefinitely. What is this stock worth to you per share if you demand a 10.8 percent rate of return on stocks of this type

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 21:00, northpolea

Suppose that kenji, an economist from an am talk radio program, and lucia, an economist from a school of industrial relations, are arguing over health insurance. the following dialogue shows an excerpt from their debate: lucia: a popular topic for debate among politicians as well as economists is the idea of providing government assistance for health benefits. kenji: i think it is oppressive for the government to tax people who take care of themselves in order to pay for health insurance for those who are obese. lucia: i disagree. i think government funding of health insurance is useful to ensure basic fairness. the disagreement between these economists is most likely due to . despite their differences, with which proposition are two economists chosen at random most likely to agree? lawyers make up an excessive percentage of elected officials. minimum wage laws do more to harm low-skilled workers than them. tariffs and import quotas generally reduce economic welfare.

Answers: 3

Business, 22.06.2019 00:00, koolja3

Chance company had two operating divisions, one manufacturing farm equipment and the other office supplies. both divisions are considered separate components as defined by generally accepted accounting principles. the farm equipment component had been unprofitable, and on september 1, 2018, the company adopted a plan to sell the assets of the division. the actual sale was completed on december 15, 2018, at a price of $600,000. the book value of the division’s assets was $1,000,000, resulting in a before-tax loss of $400,000 on the sale. the division incurred a before-tax operating loss from operations of $130,000 from the beginning of the year through december 15. the income tax rate is 40%. chance’s after-tax income from its continuing operations is $350,000. required: prepare an income statement for 2018 beginning with income from continuing operations. include appropriate eps disclosures assuming that 100,000 shares of common stock were outstanding throughout the year. (amounts to be deducted should be indicated with a minus sign. round eps answers to 2 decimal places.)

Answers: 2

Business, 22.06.2019 11:50, Attaullah2519

Christopher kim, cfa, is a banker with batts brothers, an investment banking firm. kim follows the energy industry and has frequent contact with industry executives. kim is contacted by the ceo of a large oil and gas corporation who wants batts brothers to underwrite a secondary offering of the company's stock. the ceo offers kim the opportunity to fly on his private jet to his ranch in texas for an exotic game hunting expedition if kim's firm can complete the underwriting within 90 days. according to cfa institute standards of conduct, kim: a) may accept the offer as long as he discloses the offer to batts brothers. b) may not accept the offer because it is considered lavish entertainment. c) must obtain written consent from batts brothers before accepting the offer.

Answers: 1

Business, 22.06.2019 16:00, heavenwagner

In microeconomics, the point at which supply and demand meet is called the blank price

Answers: 3

Do you know the correct answer?

5. Renew It, Inc, is preparing to pay its first dividend. It is going to pay $0.45, $0.60, and $1 a...

Questions in other subjects:

Mathematics, 30.11.2021 06:00

Spanish, 30.11.2021 06:00

Mathematics, 30.11.2021 06:00

English, 30.11.2021 06:00