Business, 19.03.2020 06:31, alleshia2007

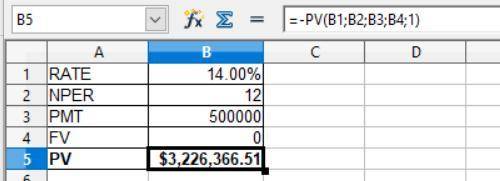

Air Atlantic (AA) has been offered a 3-year old jet airliner under a 12-year lease arrangement. The lease requires AA to make annual lease payments of $500,000 at the beginning of each of the next 12 years. Determine the present value of the lease payments if the opportunity cost of funds is 14 percent.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 04:30, fixianstewart

4. the condition requires that only one of the selected criteria be true for a record to be displayed.

Answers: 1

Business, 22.06.2019 14:30, rakanmadi87

If a product goes up in price, and the demand for it drops, that product's demand is a. elastic b. inelastic c. stable d. fixed select the best answer from the choices provided

Answers: 1

Business, 22.06.2019 21:10, elijahedgar876

Which statement or statements are implied by equilibrium conditions of the loanable funds market? a firm borrowing in the loanable funds market invests those funds with a higher expected return than any firm that is not borrowing. investment projects which use borrowed funds are guaranteed to be profitable even after paying interest expenses. the quantity of savings is maximized, thus the quantity of investment is maximized. a loan is made at the minimum interest rate of all current borrowing.

Answers: 3

Do you know the correct answer?

Air Atlantic (AA) has been offered a 3-year old jet airliner under a 12-year lease arrangement. The...

Questions in other subjects:

Biology, 26.11.2020 20:10

Mathematics, 26.11.2020 20:10

Mathematics, 26.11.2020 20:10

Mathematics, 26.11.2020 20:10

Mathematics, 26.11.2020 20:10

Health, 26.11.2020 20:10