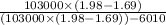

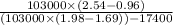

Firm R has sales of 103,000 units at $1.98 per unit, variable operating costs of $1.69 per unit, and fixed operating costs of $6,010. Interest is $10,130 per year. Firm W has sales of 103,000 units at $2.54 per unit, variable operating costs of $0.96 per unit, and fixed operating costs of $62,500. Interest is $17,400 per year. Assume that both firms are in the 40% tax bracket.

(a) Compute the degree of operating, financial, and the total leverage for firm R.

(b) Compute the degree of operating, financial, and total leverage for firm W.

(c) Compute the relative risk of the two firms.

(d) Discuss the principles of leverage that your answers illustrate.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 11:30, brucewayne390

Schonhardt corporation's relevant range of activity is 2,500 units to 5,500 units. when it produces and sells 4,000 units, its average costs per unit are as follows: averagecost per unitdirect materials $ 7.60direct labor $ 2.90variable manufacturing overhead $ 1.65fixed manufacturing overhead $ 2.90fixed selling expense $ 0.95fixed administrative expense $ 0.65sales commissions $ 0.75variable administrative expense $ 0.65if 4,500 units are produced, the total amount of fixed manufacturing cost incurred is closest to: multiple choicea $16,800b $11,400c $11,600d $15,400

Answers: 3

Business, 22.06.2019 17:40, makayladurham19

Slimwood corporation made sales of $ 725 million during 2018. of this amount, slimwood collected cash for $ 670 million. the company's cost of goods sold was $ 300 million, and all other expenses for the year totaled $ 400 million. also during 2018, slimwood paid $ 420 million for its inventory and $ 285 million for everything else. beginning cash was $ 110 million. carter's top management is interviewing you for a job and they ask two questions: (a) how much was carter's net income for 2018? (b) how much was carter's cash balance at the end of 2016? you will get the job only if you answer both questions correctly.

Answers: 1

Business, 22.06.2019 19:10, crzyemo865

Calculating and interpreting eps information wells fargo reports the following information in its 2015 form 10-k. in millions 2015 2014 wells fargo net income $24,005 $24,168 preferred stock dividends $1,535 $1,347 common stock dividends $7,400 $6,908 average common shares outstanding 5,136.5 5,237.2 diluted average common shares outstanding 5,209.8 5,324.4 determine wells fargo's basic eps for fiscal 2015 and for fiscal 2014. round answers to two decimal places.

Answers: 3

Do you know the correct answer?

Firm R has sales of 103,000 units at $1.98 per unit, variable operating costs of $1.69 per unit, and...

Questions in other subjects:

History, 02.11.2019 17:42

Mathematics, 02.11.2019 17:42

History, 02.11.2019 17:42

Mathematics, 02.11.2019 17:42

Mathematics, 02.11.2019 17:42