Business, 18.03.2020 23:01, soloriorafa

Given a 3 percent interest rate, compute the year 6 future value of deposits made in years 1, 2, 3, and 4 of $1,550, $1,750, $1,750, and $2,050. (Do not round intermediate calculations and round your final answer to 2 decimal places.)

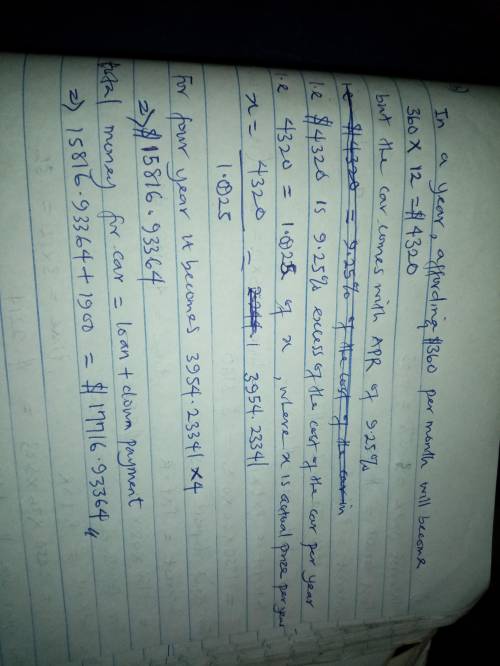

You are looking to buy a car. You can afford $360 in monthly payments for four years. In addition to the loan, you can make a $1,900 down payment. If interest rates are 9.25 percent APR, what price of car can you afford? (Do not round intermediate calculations and round your final answer to 2 decimal places.)

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 23:50, yatayjenings12

Analyzing operational changes operating results for department b of delta company during 2016 are as follows: sales $540,000 cost of goods sold 378,000 gross profit 162,000 direct expenses 120,000 common expenses 66,000 total expenses 186,000 net loss $(24,000) suppose that department b could increase physical volume of product sold by 10% if it spent an additional $18,000 on advertising while leaving selling prices unchanged. what effect would this have on the department's net income or net loss? (ignore income tax in your calculations.) use a negative sign to indicate a net loss answer; otherwise do not use negative signs with your answers. sales $answer cost of goods sold answer gross profit answer direct expenses answer common expenses answer total expenses answer net income (loss) $answer

Answers: 1

Business, 23.06.2019 01:00, heyitstierney5610

Corporation had a japanese yen receivable resulting from exports to japan and a brazilian real payable resulting from imports from brazil. gracie recorded foreign exchange gains related to both its yen receivable and real payable. did the foreign currencies increase or decrease in dollar value from the date of the transaction to the settlement date?

Answers: 2

Business, 23.06.2019 09:00, melanastormes92

Matthew decides to buy expensive designer jeans. less expensive jeans are available, but the added cost of the designer brand is worth it to matthew most likely because

Answers: 1

Business, 23.06.2019 11:20, agm0102

Suppose you purchase shares in acme gadget company for $10 per share. the company believes there is a 20 percent chance it will fail to earn a discounted future profit of $1.85. what is the expected rate of return on your investment? suppose you purchase shares in acme gadget company for $10 per share. the company believes there is a 20 percent chance it will fail to earn a discounted future profit of $1.85. what is the expected rate of return on your investment?

Answers: 1

Do you know the correct answer?

Given a 3 percent interest rate, compute the year 6 future value of deposits made in years 1, 2, 3,...

Questions in other subjects:

History, 10.11.2020 01:00

English, 10.11.2020 01:00

History, 10.11.2020 01:00

History, 10.11.2020 01:00