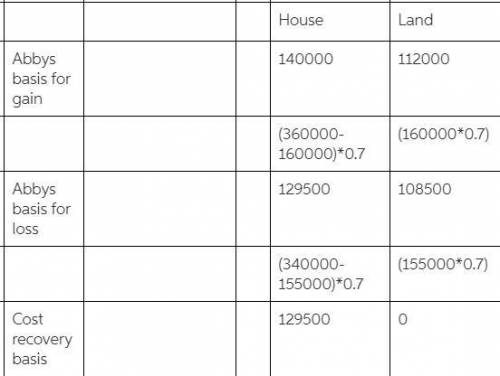

Abby's home had a basis of $360,000 ($160,000 attributable to the land) and a fair market value of $340,000 ($155,000 attributable to the land) when she converted 70% of it to business use by opening a bed-and-breakfast. Four years after the conversion, Abby sells the home for $500,000 ($165,000 attributable to the land).

Calculate Abby's basis for gain, loss, and cost recovery for the portion of her personal residence that was converted to business use.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 04:50, toyaluv2013

Steffi is reviewing various licenses and their uses. match the licenses to their respective uses. you are eligible to work within the state. you are eligible to sell limited investment securities. you are eligible to sell fixed income investment products. your compensation is fee based. section 6 section 7 section 63 section 65

Answers: 3

Business, 22.06.2019 05:50, marjae188jackson

Acompany that makes shopping carts for supermarkets and other stores recently purchased some new equipment that reduces the labor content of the jobs needed to produce the shopping carts. prior to buying the new equipment, the company used 6 workers, who produced an average of 79 carts per hour. workers receive $16 per hour, and machine coast was $49 per hour. with the new equipment, it was possible to transfer one of the workers to another department, and equipment cost increased by $11 per hour while output increased by four carts per hour. a) compute the multifactor productivity (mfp) (labor plus equipment) under the prior to buying the new equipment. the mfp (carts/$) = (round to 4 decimal places). b) compute the productivity changes between the prior to and after buying the new equipment. the productivity growth = % (round to 2 decimal places)

Answers: 3

Business, 22.06.2019 16:40, yovann

Consider two similar industries, portal crane manufacturing (pcm) and forklift manufacturing (flm). the pcm industry has exactly three incumbents with annual sales of $800 million, $200 million and $100 million, respectively. the flm industry has also exactly three incumbents, with annual sales of $500 million, $450 million and $400 million, respectively. which industry is more likely to experience a higher level of rivalry?

Answers: 3

Business, 22.06.2019 19:20, goofy44

Royal motor corp. generates a major portion of its revenues by manufacturing luxury sports cars. however, the company also derives an insignificant percent of its annual revenues by selling its sports merchandise that includes apparel, shoes, and other accessories under the same brand name. which of the following terms best describes royal motor corp.? a. aconglomerate b. a subsidiary c. adominant-businessfirm d. a single-business firm

Answers: 1

Do you know the correct answer?

Abby's home had a basis of $360,000 ($160,000 attributable to the land) and a fair market value of $...

Questions in other subjects:

Mathematics, 09.12.2020 01:00

History, 09.12.2020 01:00

Mathematics, 09.12.2020 01:00

Physics, 09.12.2020 01:00

Mathematics, 09.12.2020 01:00