Business, 16.03.2020 21:50, edeliz2804

You own a big rental car company in Indianapolis and maintain a fleet of 50 SUVs. Customers make their rental car reservations using an app before they arrive the location, and therefore, as long as a car is available in the lot they directly proceed to the car assigned them through the app for pick up. If all SUVs are rented, your customers are willing to wait until one is available. The average time between requests for an SUV is 2.5 hours, with a standard deviation of 2.5 hours. The arrival pattern remains to be consistent throughout the day (24 hrs). An SUV is rented, on average, for 4 days with a standard deviation of 1 day.

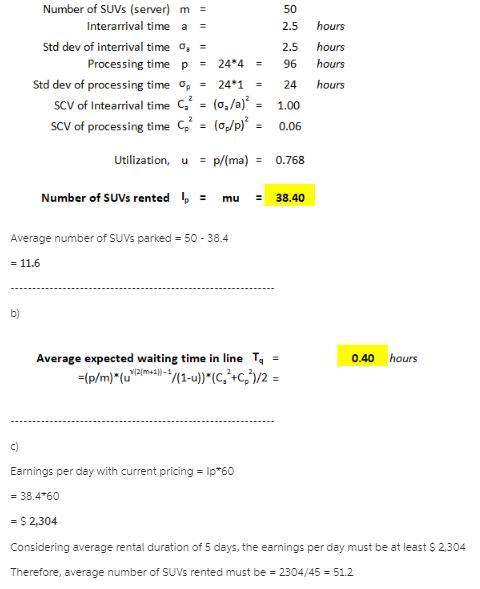

a) At any given time, what is the average number of SUVs parked in your company's lot? (Hint: you need to find the average number of SUVs rented and then subtract this number from the fleet size, i. e., 50. Make sure the time units match in your calculations.).

b) What is the average time a customer has to wait before getting a rental SUV (in (mins])?

c) ** You make a marketing survey and find that if you reduce daily rental price from $60 to $45, the average rental duration would become 5 days. What is the minimum demand rate [customers/day) that would justify the price decrease? (Assume that Va and CVp do not change). (Hint: You need to find how much you would make per day with the current pricing, i. e., Ip*$60/day, let's call it X for now. Then find how much you would make under the new pricing as a function of interarrival time [here, remember that rental duration changes). Then solve for the interarrival that gives a profit at least as high as X. Use this inter-arrival time you found to calculate the demand rate).

d) You are considering making a change on rental policy by limiting all SUV rentals to exactly 4 days. If you impose this restriction, the average interarrival time will go up to 3 hours and the standard deviation will become 3 hours. What would the waiting time be after this change in rental policy?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 20:40, julio38

If the ceo of a large, diversified, firm were filling out a fitness report on a division manager (i. e., "grading" the manager), which of the following situations would be likely to cause the manager to receive a better grade? in all cases, assume that other things are held constant. a. the division's basic earning power ratio is above the average of other firms in its industry. b. the division's total assets turnover ratio is below the average for other firms in its industry. c. the division's debt ratio is above the average for other firms in the industry. d. the division's inventory turnover is 6, whereas the average for its competitors is 8.e. the division's dso (days' sales outstanding) is 40, whereas the average for its competitors is 30.

Answers: 1

Business, 22.06.2019 22:50, esid906

Clooney corp. establishes a petty cash fund for $225 and issues a credit card to its office manager. by the end of the month, employees made one expenditure from the petty cash fund (entertainment, $20) and three expenditures with the credit card (postage, $59; delivery, $84; supplies expense, $49).record all employee expenditures, and record the entry to replenish the petty cash fund. the credit card balance will be paid later. (if no entry is required for a transaction/event, select "no journal entry required" in the first account record expenditures from credit card and the petty cash fund.

Answers: 2

Business, 22.06.2019 23:10, hannah2757

Until recently, hamburgers at the city sports arena cost $4.70 each. the food concessionaire sold an average of 13 comma 000 hamburgers on game night. when the price was raised to $5.40, hamburger sales dropped off to an average of 6 comma 000 per night. (a) assuming a linear demand curve, find the price of a hamburger that will maximize the nightly hamburger revenue. (b) if the concessionaire had fixed costs of $1 comma 500 per night and the variable cost is $0.60 per hamburger, find the price of a hamburger that will maximize the nightly hamburger profit.

Answers: 1

Do you know the correct answer?

You own a big rental car company in Indianapolis and maintain a fleet of 50 SUVs. Customers make the...

Questions in other subjects:

Mathematics, 08.12.2019 22:31

Advanced Placement (AP), 08.12.2019 22:31

Biology, 08.12.2019 22:31