Business, 16.03.2020 21:31, manoli5874

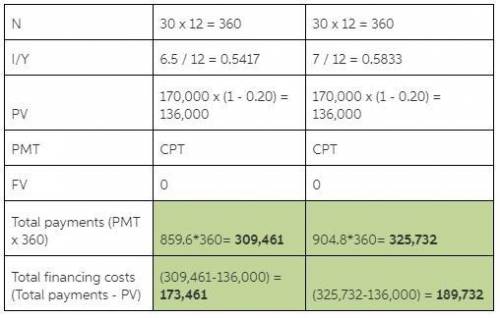

Deciding to Buy. Dave and Diane Starr of New Orleans, Louisiana, both of whom are in their late 20s, currently are renting an unfurnished two-bedroom apartment for $1,200 per month, plus $230 for utilities and $34 for insurance. They have found a condominium they can buy for $170,000 with a 20 percent down payment and a 30-year, 6.5 percent mortgage. Principal and interest payments are estimated at $860 per month, with property taxes amounting to $150 per month and a homeowner's insurance premium of $900 per year. Closing costs are estimated at $4,200. The monthly homeowners association fee is $275, and utility costs are estimated at $240 per month. The Starrs have a combined income of $90,000 per year, with take-home pay of $5,800 per month. They are in the 25 percent tax bracket, pay $225 per month on an installment loan (ten payments left), and have $39,000 in savings and investments outside of their retirement accounts. (d) Available financial information suggests that mortgage rates might increase over the next several months. If the Starrs wait until the rates increase 1/2 of 1 percent, how much more will they spend on their monthly mortgage payment

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 21:20, sophiaa23

Reqwest llc agrees to sell one hundred servers to social media networks, inc. the servers, which social media networks expressly requires to have certain amounts of memory, are to be shipped “f. o.b. social media networks distribution center in tampa, fl.” when the servers arrive, social media networks rejects them and informs reqwest, claiming that the servers do not conform to social media networks’ memory requirement. a few hours later, the servers are destroyed in a fire at social media networks’ distribution center. will reqwest succeed in a suit against social media networks for the cost of the goods?

Answers: 3

Business, 22.06.2019 03:50, haydenbell269

John is a 45-year-old manager who enjoys playing basketball in his spare time with his teenage sons and their friends. at work he finds that he is better able to solve problems that come up because of his many years of experience, but while on the court, he finds he is not as good keeping track of the ball while worrying about the other players. john's experience is:

Answers: 1

Business, 22.06.2019 10:30, salvadorjr1226p4zkp3

On july 1, oura corp. made a sale of $ 450,000 to stratus, inc. on account. terms of the sale were 2/10, n/30. stratus makes payment on july 9. oura uses the net method when accounting for sales discounts. ignore cost of goods sold and the reduction of inventory. a. prepare all oura's journal entries. b. what net sales does oura report?

Answers: 2

Business, 22.06.2019 15:30, TerronRice

In 2015, lori assigned a paid-up whole life insurance policy to an irrevocable life insurance trust (ilit) for the benefit of her three children. the ilit contained a crummey provision for the benefit of each child. at the time of the transfer, the whole life insurance policy was valued at $200,000, and since lori had not made any other taxable gifts during her lifetime, she did not owe any gift tax. lori died in 2016, and the face value of the whole life insurance policy of $2,000,000 was paid to the ilit. regarding this transfer, how much is included in lori’s gross estate at her death?

Answers: 1

Do you know the correct answer?

Deciding to Buy. Dave and Diane Starr of New Orleans, Louisiana, both of whom are in their late 20s,...

Questions in other subjects:

Biology, 17.07.2019 22:00

Social Studies, 17.07.2019 22:00

English, 17.07.2019 22:00

Biology, 17.07.2019 22:00

History, 17.07.2019 22:00

Biology, 17.07.2019 22:00

Biology, 17.07.2019 22:00

Mathematics, 17.07.2019 22:00