Business, 16.03.2020 21:16, carsondelane13

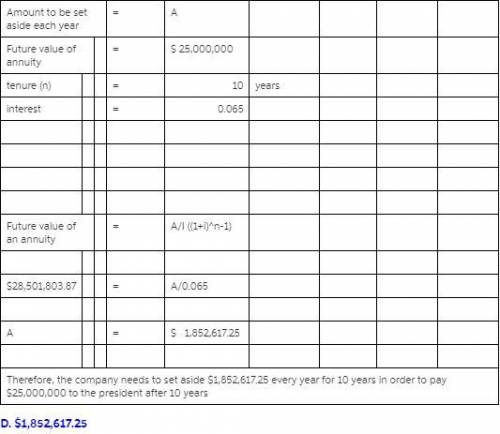

The Great Giant Corp. has a management contract with its newly hired president. The contract requires a lump sum payment of $25 million be paid to the president upon the completion of her first ten years of service. The company wants to set aside an equal amount of funds each year to cover this anticipated cash outflow. The company can earn 6.5% on these funds. How much must the company set aside each year for this purpose

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 05:30, tommyaberman

Sally is buying a home and the closing date is set for april 20th. the annual property taxes are $1,234.00 and have not been paid yet. using actual days, how much will the buyer be credited and the seller be debited

Answers: 2

Business, 22.06.2019 08:30, rajenkins79

Kiona co. set up a petty cash fund for payments of small amounts. the following transactions involving the petty cash fund occurred in may (the last month of the company's fiscal year). may 1 prepared a company check for $350 to establish the petty cash fund. 15 prepared a company check to replenish the fund for the following expenditures made since may 1. a. paid $109.20 for janitorial services. b. paid $89.15 for miscellaneous expenses. c. paid postage expenses of $60.90. d. paid $80.01 to the county gazette (the local newspaper) for an advertisement. e. counted $26.84 remaining in the petty cashbox. 16 prepared a company check for $200 to increase the fund to $550. 31 the petty cashier reports that $380.27 cash remains in the fund. a company check is drawn to replenish the fund for the following expenditures made since may 15. f. paid postage expenses of $59.10. g. reimbursed the office manager for business mileage, $47.05. h. paid $48.58 to deliver merchandise to a customer, terms fob destination. 31 the company decides that the may 16 increase in the fund was too large. it reduces the fund by $50, leaving a total of $500.

Answers: 1

Business, 22.06.2019 19:10, boi7348

Pam is a low-risk careful driver and fran is a high-risk aggressive driver. to reveal their driver types, an auto-insurance company a. refuses to insure high-risk drivers b. charges a higher premium to owners of newer cars than to owners of older cars c. offers policies that enable drivers to reveal their private information d. uses a pooling equilibrium e. requires drivers to categorize themselves as high-risk or low-risk on the application form

Answers: 3

Business, 22.06.2019 20:20, saurav76

Faldo corp sells on terms that allow customers 45 days to pay for merchandise. its sales last year were $325,000, and its year-end receivables were $60,000. if its dso is less than the 45-day credit period, then customers are paying on time. otherwise, they are paying late. by how much are customers paying early or late? base your answer on this equation: dso - credit period = days early or late, and use a 365-day year when calculating the dso. a positive answer indicates late payments, while a negative answer indicates early payments. a. 21.27b. 22.38c. 23.50d. 24.68e. 25.91b

Answers: 2

Do you know the correct answer?

The Great Giant Corp. has a management contract with its newly hired president. The contract require...

Questions in other subjects:

History, 26.02.2021 02:50

Mathematics, 26.02.2021 02:50

Mathematics, 26.02.2021 02:50

Social Studies, 26.02.2021 02:50