Business, 16.03.2020 18:08, sagetpc68741

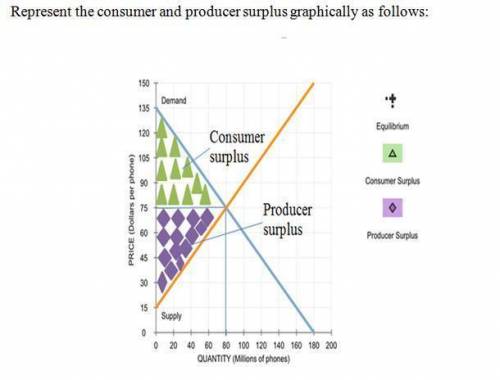

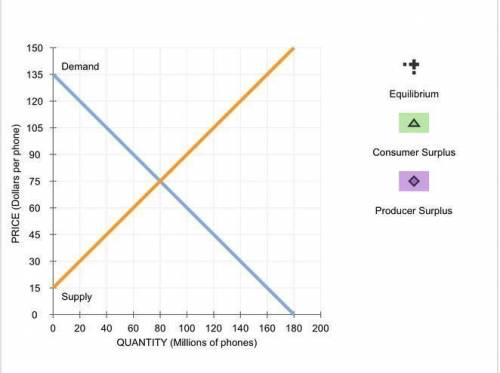

Use the black point (plus symbol) to indicate the equilibrium price and quantity of tablets. Then use the green point (triangle symbol) to fill the area representing consumer surplus, and use the purple point (diamond symbol) to fill the area representing producer surplus.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 19:20, IrieBoy7584

Why is following an unrelated diversification strategy especially advantageous in an emerging economy? a. it allows the conglomerate to overcome institutional weaknesses in emerging economies. b. it allows the conglomerate to form a monopoly in emerging economies. c. it allows the conglomerate to use well-defined legal systems in emerging economies. d. it allows the conglomerate to take advantage of strong capital markets in emerging economies.

Answers: 1

Business, 23.06.2019 15:20, andrew6494

when taxes are levied on transactions, irrespective of the party they are levied on, a. the government can absorb some of the surplus, but also creates a social loss since some of the wealth creating transactions are discouraged b. the government can absorb all the producer surplus from the transactions as revenue c. the government can absorb all of the surplus (producer and consumer) d. the government can absorb all the consumer surplus from the transactions as revenue

Answers: 2

Business, 23.06.2019 17:00, angie2118

5. understanding marginal and average tax rates consider the economy of citronia, where citizens consume only oranges. assume that oranges are priced at $1 each. the government has devised the following tax plans: plan a • consumption up to 1,000 oranges is taxed at 50%. • consumption higher than 1,000 oranges is taxed at 20%. plan b • consumption up to 2,000 oranges is taxed at 15%. • consumption higher than 2,000 oranges is taxed at 60%. use the plan a and plan b tax schemes to complete the following table by deriving the marginal and average tax rates under each tax plan at the consumption levels of 300 oranges, 1,200 oranges, and 3,000 oranges, respectively. consumption level plan a plan b (quantity of oranges) marginal tax rate average tax rate marginal tax rate average tax rate (percent) (percent) (percent) (percent) 300 1,200 3,000 complete the following table by indicating whether each plan is a progressive tax system, a proportional tax system, or a regressive tax system. progressive proportional regressive plan a plan b

Answers: 2

Business, 24.06.2019 00:30, wardlawshaliyah

In footnotes to its 2016 annual report, bancfirst corp. reported that held-to-maturity debt securities with an amortized cost of $4,365 thousand had an estimated fair value of $4,403 thousand. the balance sheet reported:

Answers: 2

Do you know the correct answer?

Use the black point (plus symbol) to indicate the equilibrium price and quantity of tablets. Then us...

Questions in other subjects:

Mathematics, 12.01.2021 20:20

Biology, 12.01.2021 20:20

English, 12.01.2021 20:20

English, 12.01.2021 20:20

Mathematics, 12.01.2021 20:20