Business, 11.03.2020 17:06, khalibarnes001

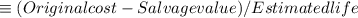

On January 1, 2017, Anodel, Inc. acquired a machine for $1,010,000. The estimated useful life of the asset is five years. Residual value at the end of five years is estimated to be $62,000. Calculate the depreciation expense per year using the straight-line method.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 14:20, demetriascott20

Xt year baldwin plans to include an additional performance bonus of 0.25% in its compensation plan. this incentive will be provided in addition to the annual raise, if productivity goals are reached. assuming the goals are reached, how much will baldwin pay its employees per hour?

Answers: 2

Business, 22.06.2019 07:50, pattydixon6

The questions of economics address which of the following ? check all that apply

Answers: 3

Business, 22.06.2019 11:30, barn01

17. chef a says that garnish should be added to a soup right before serving. chef b says that garnish should be cooked with the other ingredients in a soup. which chef is correct? a. chef a is correct. b. both chefs are correct. c. chef b is correct. d. neither chef is correct. student c incorrect which is correct answer?

Answers: 2

Do you know the correct answer?

On January 1, 2017, Anodel, Inc. acquired a machine for $1,010,000. The estimated useful life of the...

Questions in other subjects:

Mathematics, 30.08.2019 08:00

Mathematics, 30.08.2019 08:00