Business, 10.03.2020 08:26, kami23arap5p78v

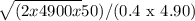

A manufacturer of exercise equipment purchases the pulley section of the equipment from a supplier who lists these prices: less than 1,000, $5 each; 1,000 to 3,999, $4.95 each; 4,000 to 5,999, $4.90 each; and 6,000 or more, $4.85 each. Ordering costs are $50, annual carrying costs per unit are 40 percent of purchase cost, and annual usage is 4,900 pulleys. Determine an order quantity that will minimize total cost.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 01:30, whocaresfasdlaf9341

If a firm plans to issue new stock, flotation costs (investment bankers' fees) should not be ignored. there are two approaches to use to account for flotation costs. the first approach is to add the sum of flotation costs for the debt, preferred, and common stock and add them to the initial investment cost. because the investment cost is increased, the project's expected return is reduced so it may not meet the firm's hurdle rate for acceptance of the project. the second approach involves adjusting the cost of common equity as follows: . the difference between the flotation-adjusted cost of equity and the cost of equity calculated without the flotation adjustment represents the flotation cost adjustment. quantitative problem: barton industries expects next year's annual dividend, d1, to be $1.90 and it expects dividends to grow at a constant rate g = 4.3%. the firm's current common stock price, p0, is $22.00. if it needs to issue new common stock, the firm will encounter a 6% flotation cost, f. assume that the cost of equity calculated without the flotation adjustment is 12% and the cost of old common equity is 11.5%. what is the flotation cost adjustment that must be added to its cost of retaine

Answers: 1

Business, 22.06.2019 10:30, batmanmarie2004

The card shoppe needs to maintain 21 percent of its sales in net working capital. currently, the store is considering a four-year project that will increase sales from its current level of $349,000 to $408,000 the first year and to $414,000 a year for the following three years of the project. what amount should be included in the project analysis for net working capital in year 4 of the project?

Answers: 3

Business, 22.06.2019 11:00, jilliand2030

Why are the four primary service outputs of spatial convenience, lot size, waiting time, and product variety important to logistics management? provide examples of competing firms that differ in the level of each service output provided to customers?

Answers: 1

Business, 22.06.2019 15:30, gracerich

University hero is considering expanding operations beyond its healthy sandwiches. jim axelrod, vice president of marketing, would like to add a line of smoothies with a similar health emphasis. each smoothie would include two free health supplements such as vitamins, antioxidants, and protein. jim believes smoothie sales should fill the slow mid-afternoon period. adding the line of smoothies would require purchasing additional freezer space, machinery, and equipment. jim provides the following projections of net sales, net income, and average total assets in support of his proposal. sandwichesonly sandwiches and smoothies net sales $ 750,000 $ 1,350,000 net income 120,000 210,000 average total assets 350,000 750,000 return on assetschoose numerator ÷ choose denominator = return on assets÷ = return on assets÷ = profit margin÷ = profit margin÷ = asset turnover÷ = asset turnover÷ = times

Answers: 2

Do you know the correct answer?

A manufacturer of exercise equipment purchases the pulley section of the equipment from a supplier w...

Questions in other subjects:

Mathematics, 28.04.2021 21:40

Mathematics, 28.04.2021 21:40

Geography, 28.04.2021 21:40

Mathematics, 28.04.2021 21:40

Mathematics, 28.04.2021 21:40

History, 28.04.2021 21:40

English, 28.04.2021 21:40

Mathematics, 28.04.2021 21:40