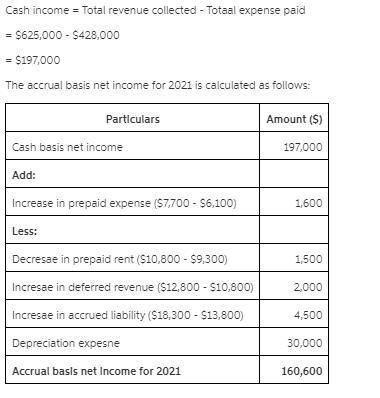

Haskins and Jones, Attorneys-at-Law, maintains its books on a cash basis. During 2021, the law firm collected $610,000 for services rendered to its clients and paid out $425,000 in expenses. You are able to determine the following information about accounts receivable, prepaid expenses, deferred service revenue, and accrued liabilities: January 1, 2021 December 31, 2021 Accounts receivable $ 75,000 $ 67,000 Prepaid insurance 5,800 7,100 Prepaid rent 10,500 9,600 Deferred service revenue 10,500 12,200 Accrued liabilities (for various expenses) 13,500 17,700 In addition, 2021 depreciation expense on office equipment is $28,500. Required: Determine accrual basis net income for 2021.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 12:50, trintrin227

Afirm’s production function is represented by q(m, r) = 4m 3/4r1/3, where q denotes output, m raw materials, and r robots. the firm is currently using 6 units of raw materials and 12 robots. according to the mrts, in order to maintain its output level the firm would need to give up 2 robots if it adds 9 units of raw materials. (a) true (b) false

Answers: 3

Business, 22.06.2019 22:40, gracebuffum

In a fixed-term, level-payment reverse mortgage, sometimes called a reverse annuity mortgage, or ram, a lender agrees to pay the homeowner a monthly payment, or annuity, and expects to be repaid from the homeowner’s equity when he or she sells the home or obtains other financing to pay off the ram. consider a household that owns a $150,000 home free and clear of mortgage debt. the ram lender agrees to a $100,000 ram for 10 years at 6 percent. assume payments are made annually, at the beginning of each year to the homeowner. calculate the annual payment on the ram.

Answers: 1

Business, 23.06.2019 10:00, dani595

Bagwell's net income for the year ended december 31, year 2 was $189,000. information from bagwell's comparative balance sheets is given below. compute the cash received from the sale of its common stock during year 2. at december 31 year 2 year 1 common stock, $5 par value $ 504,000 $ 453,600 paid-in capital in excess of par 952,000 856,600 retained earnings 692,000 585,600

Answers: 3

Do you know the correct answer?

Haskins and Jones, Attorneys-at-Law, maintains its books on a cash basis. During 2021, the law firm...

Questions in other subjects:

Geography, 07.01.2021 18:00

Social Studies, 07.01.2021 18:00

Mathematics, 07.01.2021 18:00