Business, 10.03.2020 07:04, hrijaymadathil

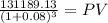

Calvin Excellenza is a new manufacturing start-up at a university city. The firm is introducing an innovative scooter based on the market survey among college students. The company plans to obtained a loan of $350000 from a bank at an interest rate of 8% to procure and install the equipment needed to start the production. Calvin assumes that the scooter will sell for the next seven years before a new design is introduced. It was estimated that 800 units will be sold in the first year. Furthermore, the volume of sales is expected to increase by 8% for the next 3 years at which time the sales will reach its peak. Afterward, it is expected that the sales will decline at a rate of 10% for the next 3 years. A unit of the product will be sold for $130 in the first year and the he price will then increase by 4% annually for the next three years. During the period of the expected declining sales (the remaining three years), the price will be reduced by 5% annually. Determine the present worth of this investment and decide if this investment is worthwhile.

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 23:00, kaylaunderwood470

Which of the following statements is correct? large corporations are taxed more favorably than sole proprietorships. corporate stockholders are exposed to unlimited liability. due to limited liability, unlimited lives, and ease of ownership transfer, the vast majority of u. s. businesses (in terms of number of businesses) are organized as corporations. most businesses (by number and total dollar sales) are organized as partnerships or proprietorships because it is easier to set up and operate in one of these forms rather than as a corporation. however, if the business gets very large, it becomes advantageous to convert to a corporation, mainly because corporations have important tax advantages over proprietorships and partnerships. most business (measured by dollar sales) is conducted by corporations in spite of large corporations’ often less favorable tax treatment, due to legal considerations related to ownership transfers and limited liability.

Answers: 3

Business, 22.06.2019 07:40, sistersquad

Myflvs -question 3 multiple choice worth 2 points)(10.04 hc)in panama city in january, high tide was at midnight. the water level at high tide was 9 feet and1 foot at low tide. assuming the next high tide is exactly 12 hours later and that the height of thewater can be modeled by a cosine curve, find an equation for water level in january for panamacity as a function of time (t).of(t) = 4 + 5of(t) = 5 cost + 4o 460) = 5 cos 1+ 4of(0) = 4 cos + 5

Answers: 1

Business, 22.06.2019 11:20, ebt2367

Money aggregates identify whether each of the following examples belongs in m1 or m2. if an example belongs in both, be sure to check both boxes. example m1 m2 gilberto has a roll of quarters that he just withdrew from the bank to do laundry. lorenzo has $25,000 in a money market account. neha has $8,000 in a two-year certificate of deposit (cd).

Answers: 3

Business, 22.06.2019 16:30, sammuelanderson1371

Which of the following has the largest impact on opportunity cost

Answers: 3

Do you know the correct answer?

Calvin Excellenza is a new manufacturing start-up at a university city. The firm is introducing an i...

Questions in other subjects:

Biology, 23.11.2020 20:10

English, 23.11.2020 20:10

Mathematics, 23.11.2020 20:10

Mathematics, 23.11.2020 20:10

English, 23.11.2020 20:10

![\left[\begin{array}{ccccc}Year&Price&Units&Revenue&PV\\1&130&800&104000&96296.3\\2&135.2&864&116812.8&100148.15\\3&140.61&933&131189.13&104142.16\\4&146.23&1008&147399.84&108343.28\\5&138.92&907&126000.44&85753.78\\6&131.97&816&107687.52&67861.4\\7&125.37&734&92021.58&53693.71\\&&&Total&616238.78\\\end{array}\right]](/tpl/images/0540/2913/bdbc3.png)