Business, 10.03.2020 02:02, nicollexo21

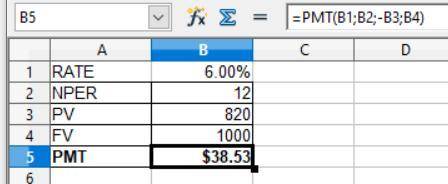

A coupon bond with 12 years remaining to maturity has a yield to maturity of 6% and a face value of $1,000 that is returned to the bondholder at maturity. The bond has a current price of $820.

Which of the following comes closest to the coupon payment of this bond?

A) $32.98 B) $38.53 C) $40.92 D) $43.30 E) $45.69

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 22:20, kota87

On january 1, jackson, inc.'s work-process inventory account showed a balance of $ 66,500. during the year, materials requisitioned for use in production amounted to $ 70,500, of which $ 67,700 represented direct materials. factory wages for the period were $ 210,000 of which $ 187,000 were for direct labor. manufacturing overhead is allocated on the basis of 60% of direct labor cost. actual overhead was $ 116,050. jobs costing $ 353,060 were completed during the year. the december 31 balance in work-process inventory is

Answers: 1

Business, 22.06.2019 17:00, whitakers87

Dan wants to start a supermarket in his hometown, and wants to get into the business only after finding out about the market and how successful his business might be. the best way for dan to gain knowledge is to:

Answers: 2

Business, 22.06.2019 18:00, Aethis

Biochemical corp. requires $600,000 in financing over the next three years. the firm can borrow the funds for three years at 10.80 percent interest per year. the ceo decides to do a forecast and predicts that if she utilizes short-term financing instead, she will pay 7.50 percent interest in the first year, 12.15 percent interest in the second year, and 8.25 percent interest in the third year. assume interest is paid in full at the end of each year. a)determine the total interest cost under each plan. a) long term fixed rate: b) short term fixed rate: b) which plan is less costly? a) long term fixed rate plan b) short term variable rate plan

Answers: 2

Do you know the correct answer?

A coupon bond with 12 years remaining to maturity has a yield to maturity of 6% and a face value of...

Questions in other subjects:

History, 04.10.2020 07:01

English, 04.10.2020 07:01

Biology, 04.10.2020 07:01

Biology, 04.10.2020 07:01

Mathematics, 04.10.2020 07:01