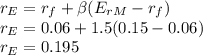

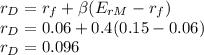

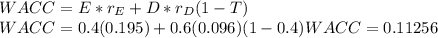

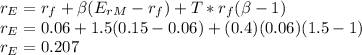

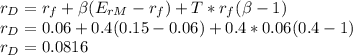

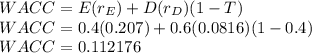

Consider a company which has β equity = 1.5 and β debt = 0.4. Suppose that the risk-free rate of interest is 6%, the expected return on the market E ( r M ) = 15%, and that the corporate tax rate is 40%. If the company has 40% equity and 60% debt in its capital structure, calculate its weighted average cost of capital using both the classic CAPM and the taxadjusted CAPM.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 04:30, stressedmolly8387

Georgia's gross pay was 35,600 this year she is to pay a federal income tax of 16% how much should georgia pay in federal income ax this year

Answers: 1

Business, 22.06.2019 06:30, mjasmine3280

The larger the investment you make, the easier it will be to: get money from other sources. guarantee cash flow. buy insurance. streamline your products.

Answers: 3

Business, 22.06.2019 12:50, tayjohn9774

Kendrick is leaving his current position at a company, and charlize is taking over. kendrick set up his powerpoint for easy access for himself. charlize needs to work in the program that is easy for her to use. charlize should reset advanced options

Answers: 3

Do you know the correct answer?

Consider a company which has β equity = 1.5 and β debt = 0.4. Suppose that the risk-free rate of int...

Questions in other subjects:

Mathematics, 01.02.2022 08:00

Chemistry, 01.02.2022 08:00

Mathematics, 01.02.2022 08:00

Mathematics, 01.02.2022 08:00

Mathematics, 01.02.2022 08:00

, cost of debt

, cost of debt is the cost of equity

is the cost of equity risk free rate

risk free rate is the volatility

is the volatility is the market return

is the market return