Business, 07.03.2020 06:11, adjjones2011

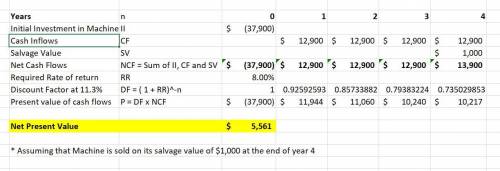

Xavier Co. wants to purchase a machine for $37,900 with a four year life and a $1,000 salvage value. Xavier requires an 8% return on investment. The expected year-end net cash flows are $12,900 in each of the four years. What is the machine's net present value

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 21:30, girlhooper4life11

Suppose that alexi and tony can sell all their street tacos for $2 each and all their cuban sandwiches for $7.25 each. if each of them worked 20 hours per week, how should they split their time between the production of street tacos and cuban sandwiches? what is their maximum joint revenue?

Answers: 3

Business, 23.06.2019 01:30, zacharysharpe2805

How is systematic decision making related to being financially responsible

Answers: 1

Business, 23.06.2019 02:30, HistoryLee

Beachballs, inc., expects abnormally high earnings for the next three years due to the forecast of unusually hot summers. after the 3-year period, their growth will level off to its normal rate of 6%. dividends and earnings are expected to grow at 20% for years 1 and 2 and 15% in year 3. the last dividend paid was $1.00. if an investor requires a 10% return on beachballs, the price she is willing to pay for the stock is closest to:

Answers: 3

Do you know the correct answer?

Xavier Co. wants to purchase a machine for $37,900 with a four year life and a $1,000 salvage value....

Questions in other subjects:

Mathematics, 25.02.2021 19:10

History, 25.02.2021 19:10

English, 25.02.2021 19:10

Mathematics, 25.02.2021 19:10