Rachel and Joey are two students who are dating. Before they left for class this morning, they decided to meet for dinner in the evening. After their last class, they go home and get ready for their date. Unfortunately, although they both remember the time—7:00 p. m.—neither of them can remember where they agreed to meet: Clementine or Beyond. Also, there is no way for them to contact each other before 7:00 p. m. Where should they go? Let’s assume that Joey prefers Clementine to Beyond, but Rachel prefers Beyond to Clementine. Joey loves Rachel, however, so he would rather be with her at Beyond than by himself at Clementine. Rachel loves Joey, so she would rather be with him at Clementine than by herself at Beyond. The figure below is the payoff matrix, where the payoffs are measured in utils (happy points).

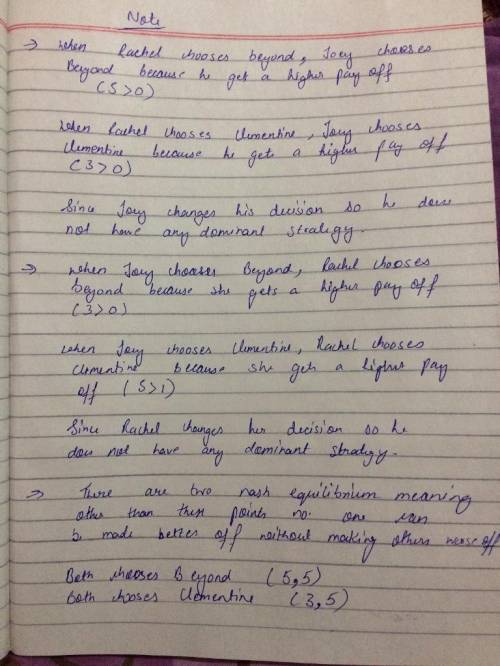

What is Joey’s dominant strategy?

What is Rachel’s dominant strategy?

What is the Nash equilibrium?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 02:30, Roof55

When interest is compounded continuously, the amount of money increases at a rate proportional to the amount s present at time t, that is, ds/dt = rs, where r is the annual rate of interest. (a) find the amount of money accrued at the end of 3 years when $4000 is deposited in a savings account drawing 5 3 4 % annual interest compounded continuously. (round your answer to the nearest cent.) $ (b) in how many years will the initial sum deposited have doubled? (round your answer to the nearest year.) years (c) use a calculator to compare the amount obtained in part (a) with the amount s = 4000 1 + 1 4 (0.0575) 3(4) that is accrued when interest is compounded quarterly. (round your answer to the nearest cent.) s = $

Answers: 1

Business, 22.06.2019 19:30, taylorray0820

Which of the following statements are false regarding activity-based costing? non-manufacturing costs are important to include when calculating the cost of each product. costs are allocated based on a pre-determined overhead rate. transitioning from traditional costing methods to activity-based costing can be complicated and costly. activity-based costing follows the same basic calculation methods as traditional costing approaches. none of the above

Answers: 2

Business, 22.06.2019 23:20, QueenNerdy889

You work as the sales manager for a company that sells office supplies to businesses of all sizes. because the profit margins are razor-thin, you need to ensure that you are getting the very best prices on paper, pencils, pens, post-it notes, and other office supplies from the manufacturers. when reviewing the quarterly profit statement, you realize that your costs are higher than they should be, and you trace the higher costs back to an employee who has been lax about getting competitive bids to ensure the lowest prices. when you conduct your research to determine the reason for the higher costs, and take action to bring those costs back down, in which of the key management processes are you taking part?

Answers: 3

Do you know the correct answer?

Rachel and Joey are two students who are dating. Before they left for class this morning, they decid...

Questions in other subjects:

Spanish, 15.02.2021 21:00

History, 15.02.2021 21:00

Mathematics, 15.02.2021 21:00

Mathematics, 15.02.2021 21:00

Mathematics, 15.02.2021 21:00

Business, 15.02.2021 21:00