Bippus Corporation manufactures two products:

Product X08R and Product P56L.

The compan...

Bippus Corporation manufactures two products:

Product X08R and Product P56L.

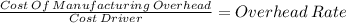

The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products X08R and P56L.

Activity Cost Pool Activity Measure Total Cost Total Activity

Machining Machine-hours $247,000 13,000 MHs

Machine setups Number of setups $60,000 150 setups

Product design Number of products $56,000 2 products

Order size Direct labor-hours $260,000 10,000 DLHs

Activity Measure Product X08R Product P56L

Machine-hours 10,000 3,000

Number of setups 110 40

Number of products 1 1

Direct labor-hours 6,000 4,000

Using the plantwide overhead rate, how much manufacturing overhead cost would be allocated to Product P56L?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 11:10, Emmaxox715

Yowell company granted a sales discount of $360 to a customer when it collected the amount due on account. yowell uses the perpetual inventory system. which of the following answers reflects the effects on the financial statements of only the discount? assets = liab. + equity rev. − exp. = net inc. cash flow a. (360 ) = na + (360 ) (360 ) − na = (360 ) (360 ) oa b. na = (360 ) + 360 360 − na = 360 na c. (360 ) = na + (360 ) (360 ) − na = (360 ) na d. na = (360 ) + 360 360 − na = 360 na

Answers: 1

Business, 22.06.2019 11:40, thedarcieisabelleand

Select the correct answer. which is a benefit of planning for your future career? a. being less prepared after high school. b. having higher tuition in college. c. earning college credits in high school. d. ruining your chances of having a successful career.

Answers: 2

Business, 22.06.2019 12:50, 20170020

Kyle and alyssa paid $1,000 and $4,000 in qualifying expenses for their two daughters jane and jill, respectively, to attend the university of california. jane is a sophomore and jill is a freshman. kyle and alyssa's agi is $135,000 and they file a joint return. what is their allowable american opportunity tax credit after the credit phase-out based on agi is taken into account?

Answers: 1

Do you know the correct answer?

Questions in other subjects:

Mathematics, 07.09.2021 01:30

Mathematics, 07.09.2021 01:30

Biology, 07.09.2021 01:30

Biology, 07.09.2021 01:30

English, 07.09.2021 01:30

Mathematics, 07.09.2021 01:30

History, 07.09.2021 01:30