Business, 03.03.2020 01:32, traybrown0690

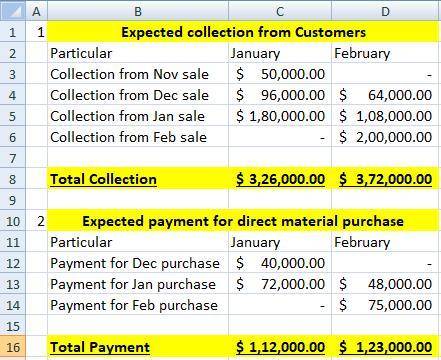

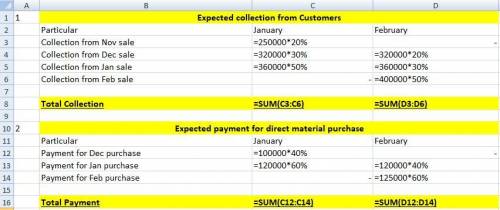

Colter Company prepares monthly cash budgets. Relevant data fromoperating budgets for 2017 are as follows:

January February

Sales 360,000 $400,000

Direct materials purchases 120,000 125,000

Direct labor 90,000 100,000

Manufacturing overhead 70,000 75,000

Selling and administrative expenses 79,000 85,000

All sales are on account. Collections are expected to be 50% in the month of sale, 30% in the first month following the sale, and 20% in the second month following the sale. Sixty percent (60%) of direct materials purchases are paid in cash in the month of purchase, and the balance due is paid in the month following the purchase. All other items above are paid in the month incurred except for selling and administrative expenses that include $1,000 of depreciation per month. Other data:

(1) Credit sales: November 2019, $250,000; December 2019, $320,000.

(2) Purchases of direct materials: December 2019, $100,000.

(3) Other receipts: January—Collection of December 31, 2019, notes receivable $15,000; February—Proceeds from sale of securities $6,000.

(4) Other disbursements: February—Payment of $6,000 cash dividend.

The companyâs cash balance on January 1, 2017, is expected to be$60,000. The company wants to maintain a minimum cash balance of$50,000.

Prepare schedules for (1) expected collections from customersand (2) expected payments for direct materials purchases forJanuary and February.

Answers: 1

Other questions on the subject: Business

Business, 23.06.2019 10:00, savannahvargas512

Top flight is a commuter airline service that provides short flights to neighboring citles around houston, texas. to determine the quantity of planes it will purchase, top flight needs to examine the for its flights at the prices it intends to charge and at the times it intends to flight. a. supply b. demand c. equilibrium price d. break-even point

Answers: 2

Business, 23.06.2019 14:00, zlittleton2008

Marta is twenty eight years old, and she has no dependents. she has saved an emergency fund and an extra $1,500. she would like to save or invest this money in hopes that it will grow fast. marta does not mind taking risks with her money. which type of account or investment is best for her? a. fifteen-year savings bond b. mutual fund c. basic savings account earning 1.3 percent interest, compounded monthly d. ida

Answers: 1

Business, 23.06.2019 22:30, sruthivada

Oswald purchased land for $48,000 and paid an additional $2,000 to install parking space. the entry to record the payment for the parking space is:

Answers: 1

Business, 24.06.2019 00:00, davismar3

Suppose a new "payment technology" allows individuals to make payments using u. s. treasury bonds (i. e., u. s. treasury bonds are immediately cashed when needed to make a payment and that balance is transferred to the payee). how do you think this payment technology would affect the transactions component of the demand for money? a. this would lead to a decreased need to hold cash for transactions; however, the transactions demand for money would remain unchanged. b. this would lead to a decreased need to hold cash for transactions, thus the transactions demand for money would decrease. c. this would lead to an increased need to hold cash for transactions, thus the transactions demand for money would increase. d. this technology would not change the transactions component of the demand for money.

Answers: 2

Do you know the correct answer?

Colter Company prepares monthly cash budgets. Relevant data fromoperating budgets for 2017 are as fo...

Questions in other subjects:

Mathematics, 25.02.2021 01:00