Business, 28.02.2020 22:28, lizzyhearts

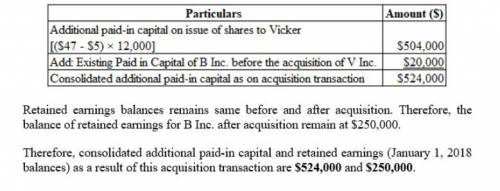

Assume that Bullen issued 12,000 shares of common stock with a $5 par value and a $47 fair value for all of the outstanding shares of Vicker. What will be the consolidated Additional Paid-In Capital and Retained Earnings (January 1, 2018 balances) as a result of this acquisition transaction?a. $524,000 and $420,000.b. $60,000 and $250,000.c. $524,000 and $250,000.d. $60,000 and $490,000.e. $380,000 and $250,000.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 03:00, sayedaly2096

5. profit maximization and shutting down in the short run suppose that the market for polos is a competitive market. the following graph shows the daily cost curves of a firm operating in this market. 0 2 4 6 8 10 12 14 16 18 20 50 45 40 35 30 25 20 15 10 5 0 price (dollars per polo) quantity (thousands of polos) mc atc avc for each price in the following table, calculate the firm's optimal quantity of units to produce, and determine the profit or loss if it produces at that quantity, using the data from the previous graph to identify its total variable cost. assume that if the firm is indifferent between producing and shutting down, it will produce. (hint: you can select the purple points [diamond symbols] on the previous graph to see precise information on average variable cost.) price quantity total revenue fixed cost variable cost profit (dollars per polo) (polos) (dollars) (dollars) (dollars) (dollars) 12.50 135,000 27.50 135,000 45.00 135,000 if the firm shuts down, it must incur its fixed costs (fc) in the short run. in this case, the firm's fixed cost is $135,000 per day. in other words, if it shuts down, the firm would suffer losses of $135,000 per day until its fixed costs end (such as the expiration of a building lease). this firm's shutdown price—that is, the price below which it is optimal for the firm to shut down—is per polo.

Answers: 3

Business, 22.06.2019 08:00, kingyogii

Suppose that xtel currently is selling at $40 per share. you buy 500 shares using $15,000 of your own money, borrowing the remainder of the purchase price from your broker. the rate on the margin loan is 8%. a. what is the percentage increase in the net worth of your brokerage account if the price of xtel immediately changes to (a) $44; (b) $40; (c) $36? (leave no cells blank - be certain to enter "0" wherever required. negative values should be indicated by a minus sign. round your answers to 2 decimal places.) b. if the maintenance margin is 25%, how low can xtel’s price fall before you get a margin call? (round your answer to 2 decimal places.) c. how would your answer to requirement 2 would change if you had financed the initial purchase with only $10,000 of your own money? (round your answer to 2 decimal places.) d. what is the rate of return on your margined position (assuming again that you invest $15,000 of your own money) if xtel is selling after one year at (a) $44; (b) $40; (c) $36? (negative values should be indicated by a minus sign. round your answers to 2 decimal places.) e. continue to assume that a year has passed. how low can xtel’s price fall before you get a margin call? (round your answer to 2 decimal places.)

Answers: 1

Business, 22.06.2019 08:40, kamarionnatillman13

The following selected circumstances relate to pending lawsuits for erismus, inc. erismus’s fiscal year ends on december 31. financial statements are issued in march 2019. erismus prepares its financial statements according to u. s. gaap. required: indicate the amount erismus would record as an asset, liability, or not accrued in the following circumstances. 1. erismus is defending against a lawsuit. erismus's management believes the company has a slightly worse than 50/50 chance of eventually prevailing in court, and that if it loses, the judgment will be $1,000,000. 2. erismus is defending against a lawsuit. erismus's management believes it is probable that the company will lose in court. if it loses, management believes that damages could fall anywhere in the range of $2,000,000 to $4,000,000, with any damage in that range equally likely. 3. erismus is defending against a lawsuit. erismus's management believes it is probable that the company will lose in court. if it loses, management believes that damages will eventually be $5,000,000, with a present value of $3,500,000. 4. erismus is a plaintiff in a lawsuit. erismus's management believes it is probable that the company eventually will prevail in court, and that if it prevails, the judgment will be $1,000,000. 5. erismus is a plaintiff in a lawsuit. erismus’s management believes it is virtually certain that the company eventually will prevail in court, and that if it prevails, the judgment will be $500,000.

Answers: 1

Business, 22.06.2019 13:10, KillerSteamcar

A4-year project has an annual operating cash flow of $59,000. at the beginning of the project, $5,000 in net working capital was required, which will be recovered at the end of the project. the firm also spent $23,900 on equipment to start the project. this equipment will have a book value of $5,260 at the end of the project, but can be sold for $6,120. the tax rate is 35 percent. what is the year 4 cash flow?

Answers: 2

Do you know the correct answer?

Assume that Bullen issued 12,000 shares of common stock with a $5 par value and a $47 fair value for...

Questions in other subjects:

Social Studies, 30.01.2021 02:00

History, 30.01.2021 02:00

Mathematics, 30.01.2021 02:00

Biology, 30.01.2021 02:00

Mathematics, 30.01.2021 02:00