Business, 28.02.2020 20:27, carafaith02

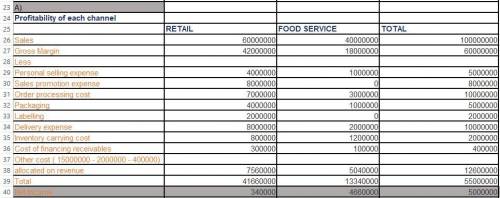

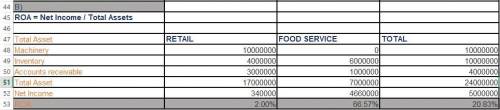

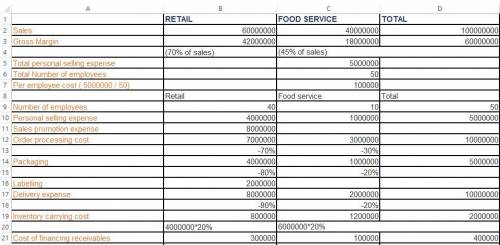

The Cooper Processing Company (CPC) is a manufacturer, or processor, of food products. Located in Lansing, Michigan, the company provides a national market with processed and packaged meat items, such as hot dogs, bologna, and sausage. Due to increased costs in marketing and logistics, CPC hired you as an expert to analyze costs and investments. After analysis, make recommendations to management. The company sells its products through two separate channels of distribution. Each is treated as a separate profit center with full financial responsibility for income statement and balance sheet. The first channel is associated with retail grocery stores and supermarkets. The second channel is associated with foodservice wholesalers who, in turn, sell to restaurants and other foodservice establishments. According to the company’s accounting records, the retail segment accounts for 60% of sales, and foodservice for 40%. The cost accountant believes that both channels are profitable. He says that the company achieves an overall average gross margin of 60% on its sales. In its most recent fiscal year, the company achieved sales of $100,000,000.The cost accountant also provides the following total costs for various marketing and logistics activities at CPC:•Personal Selling $5,000,000•Sales Promotions $8,000,000•Order processing $10,000,000•Packaging $5,000,000•Labeling $2,000,000•Delivery $10,000,000Total Marketing & Logistics costs $40,000,000The total of all other expenses at CPC is $15,000,000.The company’s cost accountant had previously allocated all expenses and investments to the channels based on the percentage of sales volume and has used the overall company average of 60% gross margin to determine the profitability of each channel of distribution. You, being much wiser than the company cost accountant, decide to do a little further analysis. The first thing you discover is that, due to differences in product mix sold in each channel, gross margins actually are different in each. You find that the gross margin in the retail channel is 70%; in the foodservice channel it is 45%.Next, you find that all of the salespeople are paid a straight salary, and all receive exactly the same amount of salary. However, you find that of the 50 sales people employed by CPC, 40 of them are devoted to the retail channel, 10 of them are devoted to the foodservice channel. Since there are no sales managers and each salesperson pays for selling expenses out of their salary, this accounts for all of the personal selling expense. You learn that all sales promotions were conducted in the retail channel. Next, you discover that there is a great difference in the number of orders placed by customers in each channel and the deliveries to each channel. You find that the retail channel accounts for 70% of the orders placed and 80% of the delivery expense. The foodservice channel accounts for 30%of the orders placed and 20% of the delivery expense. Your activity-based approach suggests that this is a reasonable way to trace the costs directly to each segment. Next you learn that packaging differs for each channel. You discover that retail accounts for 80% of the packaging cost, foodservice for 20%. (Don’t worry about how you discovered this).Next, you discover that only the retail channel requires "labeling". The company has a machine which applies these labels. The labeling expense of $2,000,000 includes materials, labor, and depreciation of the machine. The machine has an asset value of $10,000,000.Next, you find that the company has inventory of $10,000,000 (this has also been the average amount of inventory held by the company during the year). You learn that the inventory is specialized by channel. For the retail channel, the inventory is $4,000,000. For the foodservice channel the inventory is $6,000,000. Inventory carrying costs for the firm are 20%.Finally, you learn that the different channels have different terms of sale. Accounts receivable for the retail channel are (and have averaged) $3,000,000. Foodservice accounts receivable are (and have averaged) $1,000,000. You found that the cost of financing accounts receivable is 10%.As hard as you have tried, you cannot find a reasonable basis to trace any other costs or assets directly to the channel segments.1.How "profitable" is each channel?2.What is the ROA of each channel?3.Any recommendations?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 05:00, MaxxL

One question from a survey was "how many credit cards do you currently have? " the results of the survey are provided. complete parts (a) through (g) below. click the icon to view the survey results. (a) determine the mean number of credit cards based on the raw data. the mean is 3.113.11 credit cards. (type an integer or a decimal. do not round.) (b) determine the standard deviation number of credit cards based on the raw data. the standard deviation is 1.9111.911 credit cards. (round to three decimal places as needed.) (c) determine a probability distribution for the random variable, x, the number of credit cards issued to an individual. x (# of cards) p(x) x (# of cards) p(x) 1 0.280.28 6 nothing 2 nothing 7 nothing 3 nothing 8 nothing 4 nothing 9 nothing 5 nothing 10 nothing (type integers or decimals. do not round.)

Answers: 2

Business, 22.06.2019 06:00, Wocking310

Transactions on april 1 of the current year, andrea byrd established a business to manage rental property. she completed the following transactions during april: opened a business bank account with a deposit of $45,000 from personal funds. purchased office supplies on account, $2,000. received cash from fees earned for managing rental property, $8,500. paid rent on office and equipment for the month, $5,000. paid creditors on account, $1,375. billed customers for fees earned for managing rental property, $11,250. paid automobile expenses for month, $840, and miscellaneous expenses, $900. paid office salaries, $3,600. determined that the cost of supplies on hand was $550; therefore, the cost of supplies used was $1,450. withdrew cash for personal use, $2,000. required: 1. indicate the effect of each transaction and the balances after each transaction: for those boxes in which no entry is required, leave the box blank. for those boxes in which you must enter subtractive or negative numbers use a minus sign. (example: -300)

Answers: 1

Business, 22.06.2019 13:50, Jessieeeeey

Classify each of the following items as a public good, a private good, a natural monopoly good, or a common resource.(a) measles vaccinations (b) tuna in the pacific ocean (c) airline service in the united states (d) local storm-water system

Answers: 1

Business, 22.06.2019 14:00, breana758

Bayside coatings company purchased waterproofing equipment on january 2, 20y4, for $190,000. the equipment was expected to have a useful life of four years and a residual value of $9,000. instructions: determine the amount of depreciation expense for the years ended december 31, 20y4, 20y5, 20y6, and 20y7, by (a) the straight-line method and (b) the double-declining-balance method. also determine the total depreciation expense for the four years by each method. depreciation expense year straight-line method double-declining-balance method 20y4 $ $ 20y5 20y6 20y7 total $

Answers: 3

Do you know the correct answer?

The Cooper Processing Company (CPC) is a manufacturer, or processor, of food products. Located in La...

Questions in other subjects:

Chemistry, 17.07.2019 19:00

History, 17.07.2019 19:00

Mathematics, 17.07.2019 19:00

Biology, 17.07.2019 19:00

Biology, 17.07.2019 19:00

= 2.00%

= 2.00%