Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 14:30, rakanmadi87

If a product goes up in price, and the demand for it drops, that product's demand is a. elastic b. inelastic c. stable d. fixed select the best answer from the choices provided

Answers: 1

Business, 22.06.2019 20:30, Roof55

When patey pontoons issued 4% bonds on january 1, 2018, with a face amount of $660,000, the market yield for bonds of similar risk and maturity was 5%. the bonds mature december 31, 2021 (4 years). interest is paid semiannually on june 30 and december 31?

Answers: 1

Business, 23.06.2019 00:10, 201010399

Many years ago, sprint telecommunications aired an advertisement intended to demonstrate the clarity of reception sprint customers could expect. the ad showed a rancher, who had used a different company, complaining that he had ordered 100 oxen from his supplier and instead received 100 dachshunds. the mix-up was probably due to the presence of in the communication process.

Answers: 3

Do you know the correct answer?

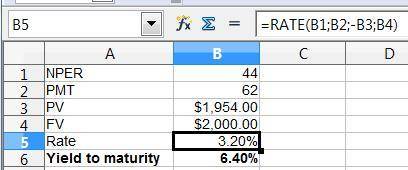

Too Young, Inc., has a bond outstanding with a coupon rate of 6.2 percent and semiannual payments. T...

Questions in other subjects:

History, 16.04.2020 21:34

Business, 16.04.2020 21:34