Business, 27.02.2020 21:11, underfellrocks

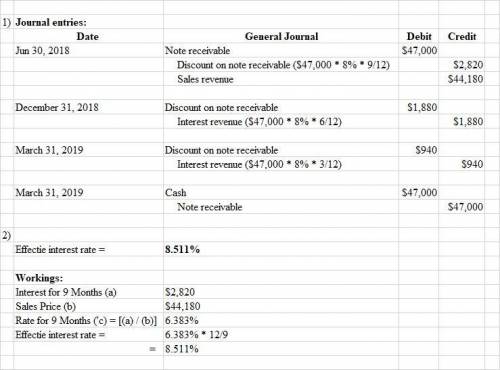

Prepare journal entries to record the sale of merchandise (omit any entry that might be required for the cost of the goods sold), the December 31, 2018 interest accrual, and the March 31, 2019 collection. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list EX 1 Record the sale of merchandise. 2 Record the interest accrual on December 31. 3 Record the interest accrual on March 31. 4 Record the cash collection Journal entry worksheet 4 Record the sale of merchandise. Note: Enter debits before credits. Date Debit Credit General Journal June 30, 2018 Record entry Clear entry View general journal Journal entry worksheet 4 Record the interest accrual on March 31. Note: Enter debits before credits Date General Journal Debit Credit March 31, 2019 Record entry Clear entry View general journal Journal entry worksheet 2 4 Record the cash collection Note: Enter debits before credits. Date General Journal Debit Credit March 31, 2019 Record entry Clear entry View general journal Required 1 Required 2 What is the effective interest rate on the note? (Round your intermediate calculations and the final percentage answer to 3 decimal places.) Effective interest rate

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 12:10, mcguirefam7071p2mbzz

Drag each label to the correct location on the image determine which actions by a manager are critical interactions - listening to complaints - interacting with customers - responding to complaints - assigning staff duties -taking action to address customer grievances -keeping track of reservations

Answers: 2

Business, 22.06.2019 12:50, axelsanchez7710

You are working on a bid to build two city parks a year for the next three years. this project requires the purchase of $249,000 of equipment that will be depreciated using straight-line depreciation to a zero book value over the three-year project life. ignore bonus depreciation. the equipment can be sold at the end of the project for $115,000. you will also need $18.000 in net working capital for the duration of the project. the fixed costs will be $37000 a year and the variable costs will be $148,000 per park. your required rate of return is 14 percent and your tax rate is 21 percent. what is the minimal amount you should bid per park? (round your answer to the nearest $100) (a) $214,300 (b) $214,100 (c) $212,500 (d) $208,200 (e) $208,400

Answers: 3

Business, 22.06.2019 22:20, vdestiny858

As a result of a labeling mistake at the chemical factory, a farmer accidentally sprays weedkiller rather than fertilizer on half her land. as a result, she loses half of her productive farmland. if the property of diminishing returns applies to all factors of production, she should expect to seea. a decrease in the marginal productivity of her remaining land and an increase in the marginal productivity of her labor. b. an increase in the marginal productivity of her remaining land and an increase in the marginal productivity of her labor. c. an increase in the marginal productivity of her remaining land and a decrease in the marginal productivity of her labor. d. a decrease in the marginal productivity of her remaining land and a decrease in the marginal productivity of her labor.

Answers: 2

Business, 22.06.2019 22:50, rydersasser12

Awork system has five stations that have process times of 5, 9, 4, 9, and 8. what is the throughput time of the system? a. 7b. 4c. 18d. 35e. 9

Answers: 2

Do you know the correct answer?

Prepare journal entries to record the sale of merchandise (omit any entry that might be required for...

Questions in other subjects:

Mathematics, 29.11.2021 20:40

Arts, 29.11.2021 20:40

Mathematics, 29.11.2021 20:40

Health, 29.11.2021 20:40

English, 29.11.2021 20:40

Mathematics, 29.11.2021 20:40